Returns in January were fairly muted, as investors balanced out the COVID-19 vaccine rollout plans with the continued rise of COVID-19 cases, and the new strains emerging, particularly in the northern hemisphere. It’s been over 12 months since the first COVID-19 case was discovered and the UK has now recorded 108,000 deaths and the US 443,000. Further lockdowns are occurring, putting further strain on some economies and their recovery. Additional restrictions on international travel will increase the impact on sectors such as tourism and education. Additional central bank support is expected, along with additional fiscal support measures. For instance, US President Joe Biden’s additional US$1.9 trillion coronavirus aid bill, on top of the US$4 trillion aid package last year, is in the process of being approved by US lawmakers currently, while the Reserve Bank of Australia announced an extension to its government bond purchase program in early February.

The Australian equity market was slightly positive in January, the ASX100 up 0.42% with Consumer Discretionary (+5.7%) and Financials and Telecommunications (both +2.3%) leading the way whilst Industrials (-3.45%) and Healthcare stocks (-1.6%) were the laggards. International equities fell by -0.82% on a currency-hedged basis while a lower AUD (down 0.65% vs the US Dollar to close at US$0.7644) increased returns slightly for unhedged investors to -0.45% for the month. Australian listed property, which some investors consider a bond proxy, fell 4.0% in January as bond yields increased.

The Australian yield curve steepened in January with the 10-year government bond yield rising 16bps to 1.13%, while the 2-year government bond yield rose by 3bps to 0.10%. In the US the 10-year government bond also rose by 16bps to close at 1.07% and the 2-year government bond yield fell by 1bps to 0.1%. Reiterating comments made last month, the movement in fixed income markets is highlighting that short-term risks to economies are real and central banks will suppress interest rates for as long as needed, but over the medium to long term inflation risks are rising as green shots of growth from economies start to emerge. Accelerating economic growth combined with a sustained low cost of money (interest rates) and interruption to supply chains could potentially underpin accelerating inflation moving forwards.

Whilst the returns from equity markets were muted there was one interesting thematic that occurred regarding retail investors trying to shake up Wall Street and in particular short-selling activity from hedge funds. Effectively retail investors collaborated and bought stock in GameStop pushing the share price up from ~US$70 a share to over US$300 a share causing hedge funds that had sold short the stock, in expectation of profiting if the share price fell, to suffer billions of dollars in losses (both realised and unrealised). Retail investors were then unable to trade on the popular brokerage-free trading platform, Robinhood, causing uproar due to there being one rule for hedge funds and another rule for retail investors effectively a statement that markets are not free for all to participate in. Regulators are now in a quandary as to how to resolve this inequity and in particular whether retail investors should be permitted to trade with leverage and be allowed to trade derivatives.

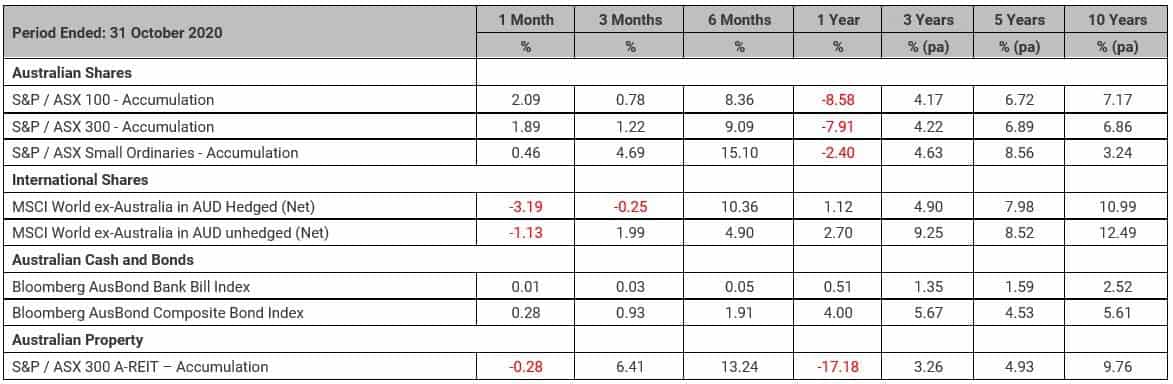

Benchmark Returns 31 January 2021

Important information

RESEARCH INSIGHTS IS A PUBLICATION OF AUSTRALIAN UNITY PERSONAL FINANCIAL SERVICES LIMITED ABN 26 098 725 145 (AUPFS). ANY ADVICE IN THIS ARTICLE IS GENERAL ADVICE ONLY AND DOES NOT TAKE INTO ACCOUNT THE OBJECTIVES, FINANCIAL SITUATION OR NEEDS OF ANY PARTICULAR PERSON. IT DOES NOT REPRESENT LEGAL, TAX OR PERSONAL ADVICE AND SHOULD NOT BE RELIED ON AS SUCH. YOU SHOULD OBTAIN FINANCIAL ADVICE RELEVANT TO YOUR CIRCUMSTANCES BEFORE MAKING PRODUCT DECISIONS. WHERE APPROPRIATE, SEEK PROFESSIONAL ADVICE FROM A FINANCIAL ADVISER. WHERE A PARTICULAR FINANCIAL PRODUCT IS MENTIONED, YOU SHOULD CONSIDER THE PRODUCT DISCLOSURE STATEMENT BEFORE MAKING ANY DECISIONS IN RELATION TO THE PRODUCT AND WE MAKE NO GUARANTEES REGARDING FUTURE PERFORMANCE OR IN RELATION TO ANY PARTICULAR OUTCOME. WHILST EVERY CARE HAS BEEN TAKEN IN THE PREPARATION OF THIS INFORMATION, IT MAY NOT REMAIN CURRENT AFTER THE DATE OF PUBLICATION AND AUSTRALIAN UNITY PERSONAL FINANCIAL SERVICES LTD (AUPFS) AND ITS RELATED BODIES CORPORATE MAKE NO REPRESENTATION AS TO ITS ACCURACY OR COMPLETENESS.