October started as a “risk on” month for equities however from the 19th October onwards markets started turning downwards. Australian equities ended the month slightly positive whereas international equities ended the month in the red. The rationale for this disparity is twofold. Firstly, COVID-19 daily cases in the northern hemisphere accelerated into the end of the month to a point of hitting record daily rates of infection in the US and in some European countries. Investors also looked to reduce risk ahead of the US Presidential Election in November. Conversely, Australian COVID-19 cases appear well under control with Victoria emerging from lockdown towards the end of October and state borders starting to open. Importantly, Australia’s major trading partners in the Asian region are also doing relatively well in managing COVID-19 allowing their economies to sustain economic recovery.

In early October Australia’s delayed Federal Budget was delivered by Treasurer Josh Frydenberg. Key features of the budget included Australia’s net debt to peak in 2024 at $966 billion – around 44% of Australia’s GDP – and the bringing forward of second stage personal tax cuts to bolster consumer confidence. The improvement in unemployment will be relatively slow with unemployment forecast to peak in December at 8%.

On November 3rd the RBA, as highly anticipated, cut the Australian cash rate to a new record low of 0.1%, additionally the RBA announced further Quantitative Easing by committing to purchase A$100 bn of government bonds with a maturity date of between 5- and 10-years maturity over the next six months, this equates to the RBA owning ~15% of Australian government bonds on issue. The RBA also noted that it is unlikely that an interest rate rise will occur within the next three years.

The Australian equity market rose 1.9% in October with Information Technology (+11%) and Consumer staples (+5%) doing the heavy lifting whilst Industrials (-4%) were the main detractor. Overseas International equities fell by 3.2% on a currency-hedged basis while a lower AUD (down 2% against the USD to close at US$0.7028) helped lessen the losses for unhedged investors to -1.1% for the month.

In anticipation of an RBA rate cut on Melbourne Cup Day the Australian yield curve steepened in October with the 10-year government bond yield rising by 4bps to 0.78% whilst the 2-year government bond yield fell by 5bps to 0.11%. In the US the 10-year government bond rose 19 bps to close at 0.87% and the 2-year government bond yield rose by 2bps to close at 0.15%.

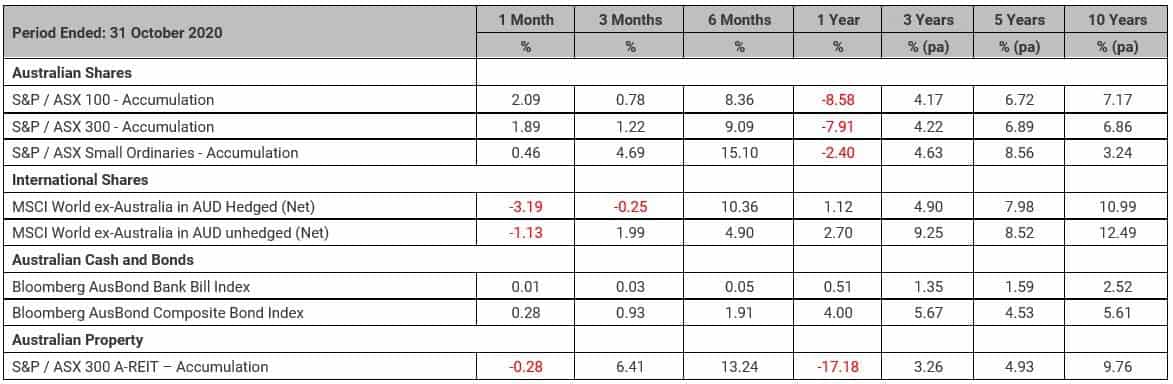

Benchmark Returns 31 October 2020

Important information

RESEARCH INSIGHTS IS A PUBLICATION OF AUSTRALIAN UNITY PERSONAL FINANCIAL SERVICES LIMITED ABN 26 098 725 145 (AUPFS). ANY ADVICE IN THIS ARTICLE IS GENERAL ADVICE ONLY AND DOES NOT TAKE INTO ACCOUNT THE OBJECTIVES, FINANCIAL SITUATION OR NEEDS OF ANY PARTICULAR PERSON. IT DOES NOT REPRESENT LEGAL, TAX OR PERSONAL ADVICE AND SHOULD NOT BE RELIED ON AS SUCH. YOU SHOULD OBTAIN FINANCIAL ADVICE RELEVANT TO YOUR CIRCUMSTANCES BEFORE MAKING PRODUCT DECISIONS. WHERE APPROPRIATE, SEEK PROFESSIONAL ADVICE FROM A FINANCIAL ADVISER. WHERE A PARTICULAR FINANCIAL PRODUCT IS MENTIONED, YOU SHOULD CONSIDER THE PRODUCT DISCLOSURE STATEMENT BEFORE MAKING ANY DECISIONS IN RELATION TO THE PRODUCT AND WE MAKE NO GUARANTEES REGARDING FUTURE PERFORMANCE OR IN RELATION TO ANY PARTICULAR OUTCOME. WHILST EVERY CARE HAS BEEN TAKEN IN THE PREPARATION OF THIS INFORMATION, IT MAY NOT REMAIN CURRENT AFTER THE DATE OF PUBLICATION AND AUSTRALIAN UNITY PERSONAL FINANCIAL SERVICES LTD (AUPFS) AND ITS RELATED BODIES CORPORATE MAKE NO REPRESENTATION AS TO ITS ACCURACY OR COMPLETENESS.

Dennis Souksamlane and Defined Financial Advice Pty Ltd are Authorised Representatives of Personal Financial Services Limited (ABN 26 098 725 145), AFS Licence no. 234459. The information provided on this website is general in nature. Any advice on this website is general advice only and does not take into account the objectives, financial situation or needs of any particular person. It does not represent legal, tax, or personal advice and should not be relied on as such. You should obtain financial advice relevant to your circumstances before making investment decisions. Personal Financial Services Limited is a registered tax (financial) adviser and any reference to tax advice contained in on this website is incidental to the general financial advice it may contain. You should seek specialist advice from a tax professional to confirm the impact of this advice on your overall tax position. Nothing on this website represents an offer or solicitation in relation to securities or investments in any jurisdiction. Where a particular financial product is mentioned, you should consider the Product Disclosure Statement before making any decisions in relation to the product and we make no guarantees regarding future performance or in relation to any particular outcome. Whilst every care has been taken in the preparation of this information, it may not remain current after the date of publication and Personal Financial Services Limited and its related bodies corporate make no representation as to its accuracy or completeness.