Growth assets declined in September. Investors adopted a more cautious stance due to a number of factors such as: The acceleration of COVID-19 cases globally, particularly the rise in the northern hemisphere; the lack of further stimulus or bond buying programs announced by central banks; and uncertainty around the US Presidential election on 3rd November.

Australia’s unemployment rate surprisingly fell to 6.8% from 7.5% in August. Without the Government’s JobKeeper program the unemployment rate would likely exceed 10% however with COVID-19 being contained and Victorian infection numbers falling hopefully “normality” can be resumed by November. We expect the biggest impacts to the economy will be from overseas tourists and international students , and on industries such as agriculture and viticulture that rely on the “backpacking” workforce.

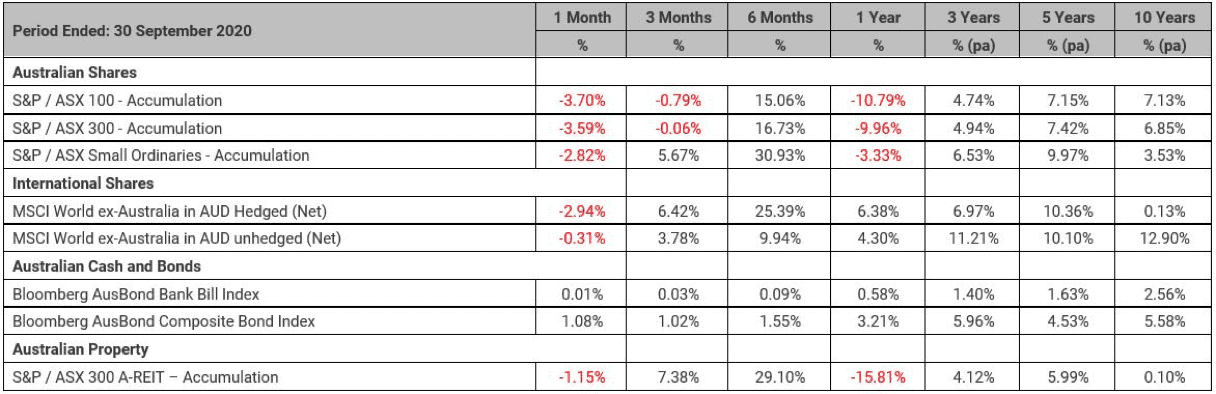

The Australian equity market erased the gains of July and August and fell 3.6% in September with the Financial, Information Technology and Energy sectors amongst the worst performing sectors. During the month Westpac Banking Corporation agreed to pay the largest fine in Australian corporate history – a $1.3 billion civil penalty for 23 million breaches of anti-money laundering laws.

Technology stocks globally saw a rare period of profit taking with the technology heavy NASDAQ Composite Index in the US falling 5.2% in September. This was replicated in Australian technology stocks with the local Information Technology sector falling by 6.4% for the month. International equities fell by 2.9% on a currency-hedged basis while a lower AUD (down 3% against the USD to close at US$0.717) helped lessen the losses for unhedged investors to -0.3% for the month.

The RBA left interest rate and other policy settings on hold at their October 6th meeting however a rate cut to bring the cash rate down from 0.25% to 0.10% is highly anticipated at their November policy meeting. The Australian yield curve fell in August with the 10-year government bond yield falling by 20bps to 0.78% whilst the 2-year government bond yield fell by 9bps to 0.16% in anticipation of an imminent RBA interest rate cut. In the US the 10-year government bond yield fell 3bps to close at 0.68% and the 2-year government bond yield was flat at 0.13%.

Quick Budget Snapshot

- Infrastructure investment of an additional $7.5bn across all states/territories

- A range of targeted investment measures to support industry and businesses and help them to recover from the last 6 months

- For business with turnover up to $5bn there is an immediate deduction on capital assets acquired and they will also be able to offset losses against previous taxed profits

- Personal income tax reductions potentially back dated to take effect 1 July 2020

Important information

RESEARCH INSIGHTS IS A PUBLICATION OF AUSTRALIAN UNITY PERSONAL FINANCIAL SERVICES LIMITED ABN 26 098 725 145 (AUPFS). ANY ADVICE IN THIS ARTICLE IS GENERAL ADVICE ONLY AND DOES NOT TAKE INTO ACCOUNT THE OBJECTIVES, FINANCIAL SITUATION OR NEEDS OF ANY PARTICULAR PERSON. IT DOES NOT REPRESENT LEGAL, TAX OR PERSONAL ADVICE AND SHOULD NOT BE RELIED ON AS SUCH. YOU SHOULD OBTAIN FINANCIAL ADVICE RELEVANT TO YOUR CIRCUMSTANCES BEFORE MAKING PRODUCT DECISIONS. WHERE APPROPRIATE, SEEK PROFESSIONAL ADVICE FROM A FINANCIAL ADVISER. WHERE A PARTICULAR FINANCIAL PRODUCT IS MENTIONED, YOU SHOULD CONSIDER THE PRODUCT DISCLOSURE STATEMENT BEFORE MAKING ANY DECISIONS IN RELATION TO THE PRODUCT AND WE MAKE NO GUARANTEES REGARDING FUTURE PERFORMANCE OR IN RELATION TO ANY PARTICULAR OUTCOME. WHILST EVERY CARE HAS BEEN TAKEN IN THE PREPARATION OF THIS INFORMATION, IT MAY NOT REMAIN CURRENT AFTER THE DATE OF PUBLICATION AND AUSTRALIAN UNITY PERSONAL FINANCIAL SERVICES LTD (AUPFS) AND ITS RELATED BODIES CORPORATE MAKE NO REPRESENTATION AS TO ITS ACCURACY OR COMPLETENESS.

Dennis Souksamlane and Defined Financial Advice Pty Ltd are Authorised Representatives of Personal Financial Services Limited (ABN 26 098 725 145), AFS Licence no. 234459. The information provided on this website is general in nature. Any advice on this website is general advice only and does not take into account the objectives, financial situation or needs of any particular person. It does not represent legal, tax, or personal advice and should not be relied on as such. You should obtain financial advice relevant to your circumstances before making investment decisions. Personal Financial Services Limited is a registered tax (financial) adviser and any reference to tax advice contained in on this website is incidental to the general financial advice it may contain. You should seek specialist advice from a tax professional to confirm the impact of this advice on your overall tax position. Nothing on this website represents an offer or solicitation in relation to securities or investments in any jurisdiction. Where a particular financial product is mentioned, you should consider the Product Disclosure Statement before making any decisions in relation to the product and we make no guarantees regarding future performance or in relation to any particular outcome. Whilst every care has been taken in the preparation of this information, it may not remain current after the date of publication and Personal Financial Services Limited and its related bodies corporate make no representation as to its accuracy or completeness.