Superannuation

Minimum pension drawdown

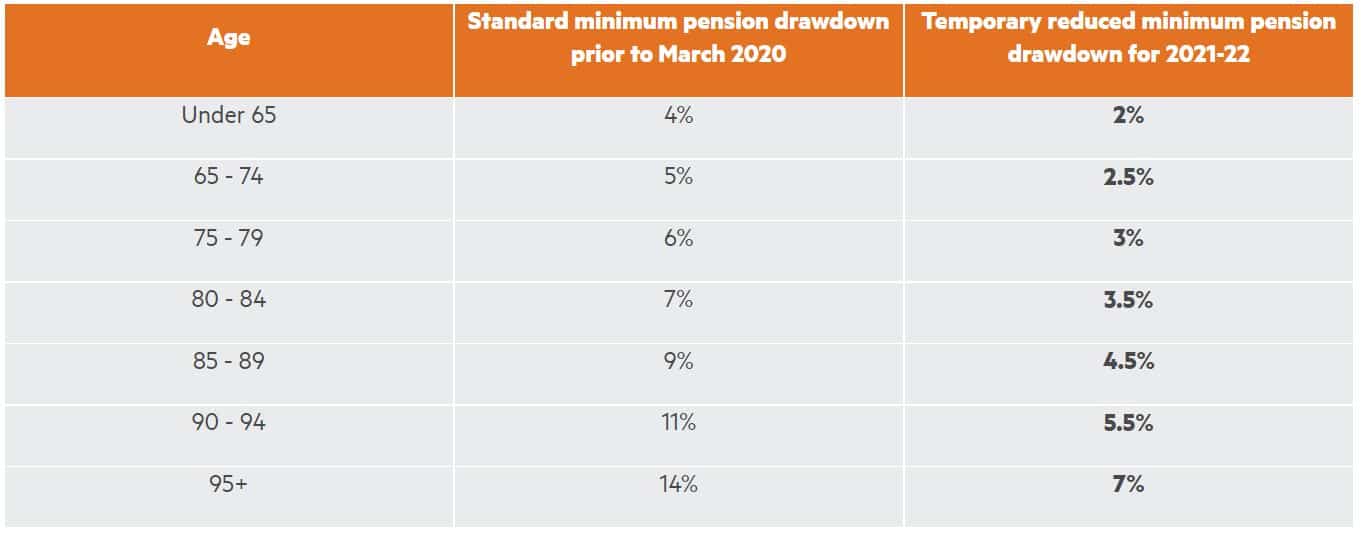

The Government has announced that the temporary 50% reduction to the minimum pension drawdown amounts – the minimum mandatory amount you must withdraw from your pension account each year – will be extended until 30 June 2022.

The Government temporarily halved minimum drawdown amounts in March 2020 in response to the COVID-19 pandemic. This was introduced to allow pension members to withdraw less of their retirement savings and keep a greater amount invested.

These temporary minimum amounts were due to return to standard levels from 1 July 2021, however on 29 May 2021 the Government advised temporary minimums would be extended.

The full set of standard and temporary rates for each age group are outlined in the table below:

What does this change mean to you?

If you previously chose to receive the ‘standard’ minimum pension payment, your super fund may automatically apply the ‘temporary’ minimum pension payment based on your age and account balance on 1 July 2021. As a result, you may receive 50% less than anticipated over the new financial year.

If you need more than the ‘temporary’ minimum pension payment or are unsure of how this change could impact your pension, contact your financial adviser or the pension provider.

If you previously chose to receive a ‘nominated’ amount, and this amount falls below your new minimum for 2021-22, your payment will automatically be brought up to the minimum amount. If your nominated amount is higher than the minimum, it will stay the same, unless you decide to change it.

Superannuation guarantee increase to 10%

The superannuation guarantee (SG) is the minimum percentage of your ordinary time earnings that your employer has to pay into your superannuation fund, if you meet certain conditions.

On the 1st of July 2021, the SG will increase from 9.5% to 10%.

If your employer uses an up-to-date payroll system that complies with Single Touch Payroll (STP) these changes should be relatively simple to comply with as new employees engaged on or after 1 July 2021 will automatically be registered under the new changes.

If you are a salaried employee, you should check your first payroll statement in the new financial year to ensure your employer has made the correct amount of SG contributions on your behalf.

What does this change mean to you?

There is a cap on concessional contributions which include SG, salary sacrifice and contributions which you claim as a tax deduction (known as ‘personal deductible contributions’).

As employer SG contributions count towards the concessional contributions cap and an increase to SG means more of your cap will be taken up by the SG, if you have an existing salary sacrifice arrangement you may wish to review the strategy with your financial adviser to ensure you avoid accidentally exceeding your contributions cap.

Contribution cap increases

Indexation will be applied to the superannuation contribution caps for the first time since 1 July 2017. The new contribution caps will apply from 1 July 2021 as follows:

- the cap for concessional contributions will increase from $25,000 to $27,500

- the cap for non-concessional contributions will increase from $100,000 to $110,000

- these changes will also have ‘flow-on’ effects on other superannuation contribution measures such as the three year bring forward rule (for non-concessional contributions) and the carry-forward unused concessional contributions rule

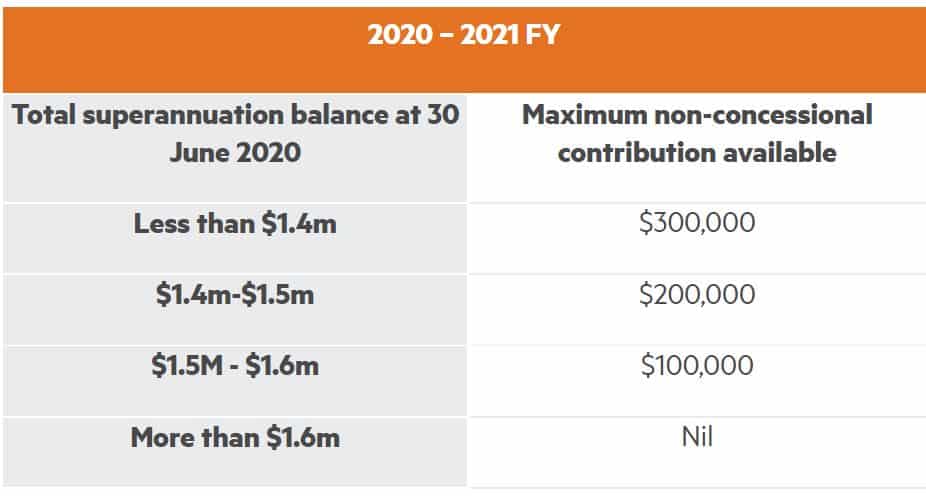

Increase to eligibility age for bring forward provision

The bring forward provision enables those under the age of 67 to contribute three years’ worth of non-concessional contributions in one financial year. Legislation was passed in late June to allow individuals aged 65 and 66 to utilise the bring forward rule from 1 July 2020.

This means from 1 July 2021, you can contribute up to $330,000 in a financial year. If you have utilised the bring forward rule in 2018-19 or 2019-20, then your contribution cap will not increase until the existing three year bring forward period has passed.

These are caps on the amount that can be paid into your super account in a financial year. If you contribute more than these caps, you may have to pay extra tax.

If you have available savings and would like to contribute these amounts to super, contact your financial adviser who can confirm your eligibility to make non-concessional contributions, including the bring forward provision.

General transfer balance cap increase

The transfer balance cap is the maximum total amount of superannuation that can be transferred into the retirement phase. If you have more than one super account, the combined balances are used to calculate this amount.

On the 1st of July 2021, the general transfer balance cap will increase from $1.6 million to $1.7 million. However not everyone will benefit from the increase. From 1 July 2021, there will not be a single cap that applies to everyone. Instead, anyone who has previously commenced a retirement phase income stream (pension) will have their own personal TBC of between $1.6 and $1.7 million, depending on their circumstances.

Further detail is available on the Australian Taxation Office website.

Increase to preservation age

From 1 July 2021, preservation age increases from age 58 to 59.

Preservation age is generally the age at which individuals can first access their super. Reaching preservation age allows you to:

- Rollover your super to commence a transition to retirement income stream.

- Access your entire super balance (subject to satisfying a condition of release). A change in preservation age also affects tax applied to your super withdrawals. If you satisfy a condition of release, are aged between preservation age and age 60, you can access the low rate cap ($225,000 for the 2021-22 FY) which effectively reduces any tax on lump sums withdrawn up to the cap, to nil.

- You may satisfy a condition of release if, upon reaching preservation age, you retire i.e. you have ceased gainful employment and have no intention of becoming gainfully employed again in the future. Where a condition of release has been met, you can access your entire super balance as a lump sum or roll it over to commence a retirement income stream such as an accountbased pension.

Increase SMSF member number from four to six

In the new financial year, the maximum number of members permitted in an SMSF will increase from four to six. This change will bring additional flexibility and choice within the current superannuation and retirement saving system. It may allow more working family members to join the family SMSF and have their super balances and future contributions directed to the family SMSF. This could further enhance the capital base of the SMSF and provide the SMSF with greater flexibility to invest in more substantial projects or further diversify investments. Furthermore, larger balances within a SMSF may reduce the overall cost of running a SMSF on a percentage basis.

Tax

Low and Middle Income Tax Offset (LMITO)

The LMITO provides individuals with taxable incomes between $48,000 and $90,000 with a maximum offset of $1,080. If you earn less than $37,000, you will see a benefit of up to $255. If you earn between $90,000 and $126,000, you will see the offset phase out at a rate of 3 cents a dollar.

Originally set to lapse on 30 June 2020, the Government has extended the LMITO to 30 June 2022.

Tax deductions for super contributions

Taking advantage of opportunities to grow your super while reducing your tax can have long term benefits. You can potentially claim a tax deduction for some superannuation contributions you make directly from after-tax income such as savings in the bank to your super fund during the new financial year.

These are known as ‘personal deductible contributions’ and count towards your concessional contributions cap.

Before claiming a deduction for these contributions, you must give your super fund a notice of intent form and receive an acknowledgement from your fund. Other eligibility criteria apply also.

Your financial adviser can assist you with this process to help ensure you remain within contribution caps and avoid paying extra tax.

Expanded access to small business concessions

Your business may now be eligible for most small business tax concessions. From 1 July 2021, business that are not small businesses because their turnover is $10 million or more but less than $50 million can also access these small business concessions:

- simplified trading stock rules

- PAYG instalments concession

- a two-year amendment period

- excise concession

Increased small business income tax offset

You can claim the small business income tax offset if you either:

- are a small business sole trader

- have a share of net small business income from a partnership or trust

- the small business income tax offset applies to small businesses with turnover less than $5 million. The rate of offset is:

- 13% in 2020–21

- 16% from 2021–22

- the maximum offset is $1,000 and the ATO work out your offset based on amounts shown in your tax return

Lower company tax rate changes

The lower company tax rate for base rate entities reduced to 26% in 2020–21 and will be 25% from the 2021–22 income year. A base rate entity is a company that both:

- has an aggregated turnover less than the aggregated turnover threshold– which is $25 million for the 2017–18 income year and $50 million for the 2018–19 to 2021–22 income years

- 80% or less of their assessable income is base rate entity passive income (such as interest, dividends, rent, royalties and net capital gain) – this replaces the requirement to be carrying on a business

- when working out the rate to use when franking your distributions, you need to assume that your aggregated turnover, assessable income and base rate passive income will be the same as the previous year

Next steps…

If you have any questions about this update, or would like to discuss how these changes impact you, contact your financial adviser today.

Author: Yvonne Chu, Head of Technical Services, Australian Unity

Important information

This information has been produced by Australian Unity Personal Financial Services Ltd (‘AUPFS’) ABN 26 098 725 145, AFSL 234459. Any advice in this document is general advice only and does not take into account the objectives, financial situation or needs of any particular person. It does not represent legal, tax, or personal advice and should not be relied on as such. You should obtain financial advice relevant to your circumstances before making investment decisions. AUPFS is a registered tax (financial) adviser and any reference to tax advice contained in this document is incidental to the general financial advice it may contain. You should seek specialist advice from a tax professional to confirm the impact of this advice on your overall tax position. Nothing in this document represents an offer or solicitation in relation to securities or investments in any jurisdiction. Where a particular financial product is mentioned, you should consider the Product Disclosure Statement before making any decisions in relation to the product and we make no guarantees regarding future performance or in relation to any particular outcome. Whilst every care has been taken in the preparation of this information, it may not remain current after the date of publication and AUPFS and its related bodies corporate make no representation as to its accuracy or completeness. Published: June 2021 © Copyright 2021

Dennis Souksamlane and Defined Financial Advice Pty Ltd are Authorised Representatives of Personal Financial Services Limited (ABN 26 098 725 145), AFS Licence no. 234459. The information provided on this website is general in nature. Any advice on this website is general advice only and does not take into account the objectives, financial situation or needs of any particular person. It does not represent legal, tax, or personal advice and should not be relied on as such. You should obtain financial advice relevant to your circumstances before making investment decisions. Personal Financial Services Limited is a registered tax (financial) adviser and any reference to tax advice contained in on this website is incidental to the general financial advice it may contain. You should seek specialist advice from a tax professional to confirm the impact of this advice on your overall tax position. Nothing on this website represents an offer or solicitation in relation to securities or investments in any jurisdiction. Where a particular financial product is mentioned, you should consider the Product Disclosure Statement before making any decisions in relation to the product and we make no guarantees regarding future performance or in relation to any particular outcome. Whilst every care has been taken in the preparation of this information, it may not remain current after the date of publication and Personal Financial Services Limited and its related bodies corporate make no representation as to its accuracy or completeness.