Once again equity markets pushed higher in the month of June and it appears nothing can stop equities from moving higher. The US President announced that he has bipartisan support for a US$1.2 trillion infrastructure deal that should lead to the continued recovery, and almost 50% of the US population has now been fully vaccinated. Australian employment numbers were strong, with the unemployment rate falling from 5.5% in April to 5.1% in May, however with Australia’s vaccine rollout lagging the world and COVID lockdowns occurring in various Australian states, the economy could be subject to further shocks.

US inflation rose to a 13-year high of 5% in May (measured year-on year) and despite the Federal Reserve downplaying that inflation is transitory and not structural, the Federal Reserve’s “Dot Plots” show that officials expect a US rate rise in 2023. This initially saw bond yields move higher but also saw the US Dollar strengthen which perhaps breaks the nexus that the US dollar will be permanently weak due to the large government deficit. Later in the month bond yields began to move lower as bond markets responded to an increasing probability of COVID-19 lockdowns in some regions due to further outbreaks of the new and more transmittable COVID strains.

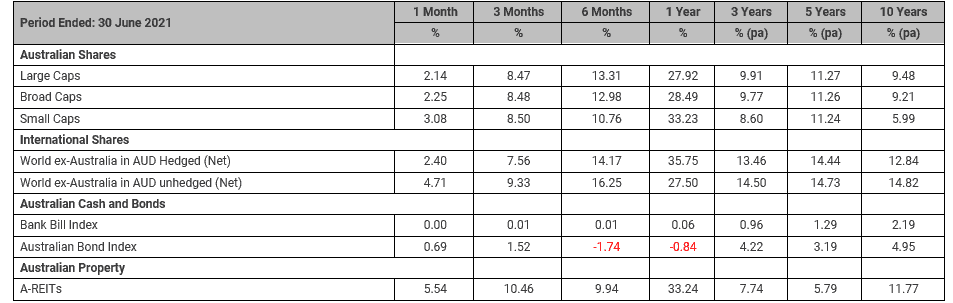

The Australian share market was positive in June with large caps up 2.1% and the ASX hitting a new all-time high. The only sector to fall was Financials (-0.5%) whilst the Technology sector that sold off in May was the strongest sector in June gaining 14.5%. Small caps outperformed large caps, gaining 3.0%.

International equities rose by 2.4% on a currency-hedged basis and with the US dollar appreciating by 3% (seeing the AUD fall from US$0.7716 to US$0.7497), unhedged investors enjoyed a 4.7% gain for the month. US equities continued to make all-time highs as the Technology sector outperformed.

Bond yields ended the month lower with the Australian 10-year government bond yield falling 18bps to 1.53% and the 2-year government bond was flat at 0.06%. In the US the 10-year government bond fell by 13bps to close at 1.47% while the 2-year government bond yield rose by 11bps to 0.25% on speculation of a rate rise in 2023.

Australian Listed Property rose 5.5% in the month – as a combination of increased corporate activity and lower bond yields buoyed prices.

Benchmark Returns

Important information

RESEARCH INSIGHTS IS A PUBLICATION OF AUSTRALIAN UNITY PERSONAL FINANCIAL SERVICES LIMITED ABN 26 098 725 145 (AUPFS). ANY ADVICE IN THIS ARTICLE IS GENERAL ADVICE ONLY AND DOES NOT TAKE INTO ACCOUNT THE OBJECTIVES, FINANCIAL SITUATION OR NEEDS OF ANY PARTICULAR PERSON. IT DOES NOT REPRESENT LEGAL, TAX OR PERSONAL ADVICE AND SHOULD NOT BE RELIED ON AS SUCH. YOU SHOULD OBTAIN FINANCIAL ADVICE RELEVANT TO YOUR CIRCUMSTANCES BEFORE MAKING PRODUCT DECISIONS. WHERE APPROPRIATE, SEEK PROFESSIONAL ADVICE FROM A FINANCIAL ADVISER. WHERE A PARTICULAR FINANCIAL PRODUCT IS MENTIONED, YOU SHOULD CONSIDER THE PRODUCT DISCLOSURE STATEMENT BEFORE MAKING ANY DECISIONS IN RELATION TO THE PRODUCT AND WE MAKE NO GUARANTEES REGARDING FUTURE PERFORMANCE OR IN RELATION TO ANY PARTICULAR OUTCOME. WHILST EVERY CARE HAS BEEN TAKEN IN THE PREPARATION OF THIS INFORMATION, IT MAY NOT REMAIN CURRENT AFTER THE DATE OF PUBLICATION AND AUSTRALIAN UNITY PERSONAL FINANCIAL SERVICES LTD (AUPFS) AND ITS RELATED BODIES CORPORATE MAKE NO REPRESENTATION AS TO ITS ACCURACY OR COMPLETENESS.

Dennis Souksamlane and Defined Financial Advice Pty Ltd are Authorised Representatives of Personal Financial Services Limited (ABN 26 098 725 145), AFS Licence no. 234459. The information provided on this website is general in nature. Any advice on this website is general advice only and does not take into account the objectives, financial situation or needs of any particular person. It does not represent legal, tax, or personal advice and should not be relied on as such. You should obtain financial advice relevant to your circumstances before making investment decisions. Personal Financial Services Limited is a registered tax (financial) adviser and any reference to tax advice contained in on this website is incidental to the general financial advice it may contain. You should seek specialist advice from a tax professional to confirm the impact of this advice on your overall tax position. Nothing on this website represents an offer or solicitation in relation to securities or investments in any jurisdiction. Where a particular financial product is mentioned, you should consider the Product Disclosure Statement before making any decisions in relation to the product and we make no guarantees regarding future performance or in relation to any particular outcome. Whilst every care has been taken in the preparation of this information, it may not remain current after the date of publication and Personal Financial Services Limited and its related bodies corporate make no representation as to its accuracy or completeness.