How can the value of financial advice be measured?

The financial benefits of professional advice can often out-weigh the cost.

The ‘value’ of financial advice can be considered both tangible and intangible—and will have different meanings for different people.

For some, the value of advice received will be measured by how much tax was saved, the age at which retirement was reached, the improvement in benefit entitlements or the final worth of an investment portfolio. Many will measure the ‘value’ against the cost of paying for that advice.

For others, the focus will be relative to a sense of wellbeing, peace of mind, having financial security and control over decisions made. This ‘intangible’ value of this advice is harder to measure and cannot be as easily weighed up against the cost of that advice. For example, how much is the right amount to pay for peace of mind and for financial freedom? The answer to this will vary from person to person.

How financial advice can be valuable

Recent reports indicate that over a third of Australians are dissatisfied with their financial situation.1

We believe that financial advice can play a significant role in helping to change this outcome. Professional financial advice can make a world of difference emotionally, behaviourally and financially.

Emotional

Financial advice can have a big impact on overall wellbeing and financial security. The help of a qualified financial adviser can provide greater peace of mind and better clarity or management over finances. Research had found that:

- People with a financial adviser feel 15 per cent more financially secure than those without.2

- Over three-quarters of people with a financial adviser say it contributes to greater peace of mind.3

- More than 80 per cent of people with a financial adviser report greater confidence with their financial decision making.3

Behavioural

Behavioural coaching is one of the most valuable services a financial adviser provides to their clients. They can help clients maintain a long-term perspective and stay disciplined towards achieving goals. For example, emotion can play a significant role when investing in the share market. Abandoning a planned investment strategy, chasing short term market volatility or past performance, could result in costly losses, in turn impacting overall financial security. But with the steady guidance of a financial adviser these common behavioural tendencies can be avoided.

A financial adviser will also help adjust money habits, with research indicating that:

- Over 50 per cent of people say financial advice has helped them to save more.3

- Sixty percent of people with a financial adviser feel better equipped to handle sudden, one-off costs.3

- Half of people with a financial adviser say they could cover living expenses for six months or longer if they were suddenly unable to work. Compared to only a quarter of people without a financial adviser.3

Financial

In terms of financial benefits, Russell Investments estimates that financial advisers can deliver 5.2% p.a. or more of value each year for clients.4 This means for example, a financial adviser charging an advice fee of $3,250 to a client with a $250,000 balance can potentially deliver $13,250 of value – that’s $10,000 extra value to the client.5

Similarly, a recent Financial Services Council report by Rice Warner assessed the value derived from different levels of advice.6 They found:

- At any age, for average Australians, financial advice will likely add value to both an individual’s superannuation and personal wealth by the time they retire.

- Savings and investment advice, taken at a young age, provides the greatest increase in funds at retirement. This is because younger individuals have a greater investment period over which to compound the benefits of higher rates of return.

- Irrespective of wealth, for an individual aged 40, approximately half the value of the ‘full’ advice scenario is from ‘simple’ advice in respect of savings.

Financial advice is not just beneficial for the wealthy, those with lower economic wealth can potentially gain more from advice than those who are wealthy. This reflects the tendency for this group to save less of their disposable income (in proportional terms) and allocate assets to safe but low- yielding asset classes (such as cash and term deposits).

How financial advice can help at any life stage

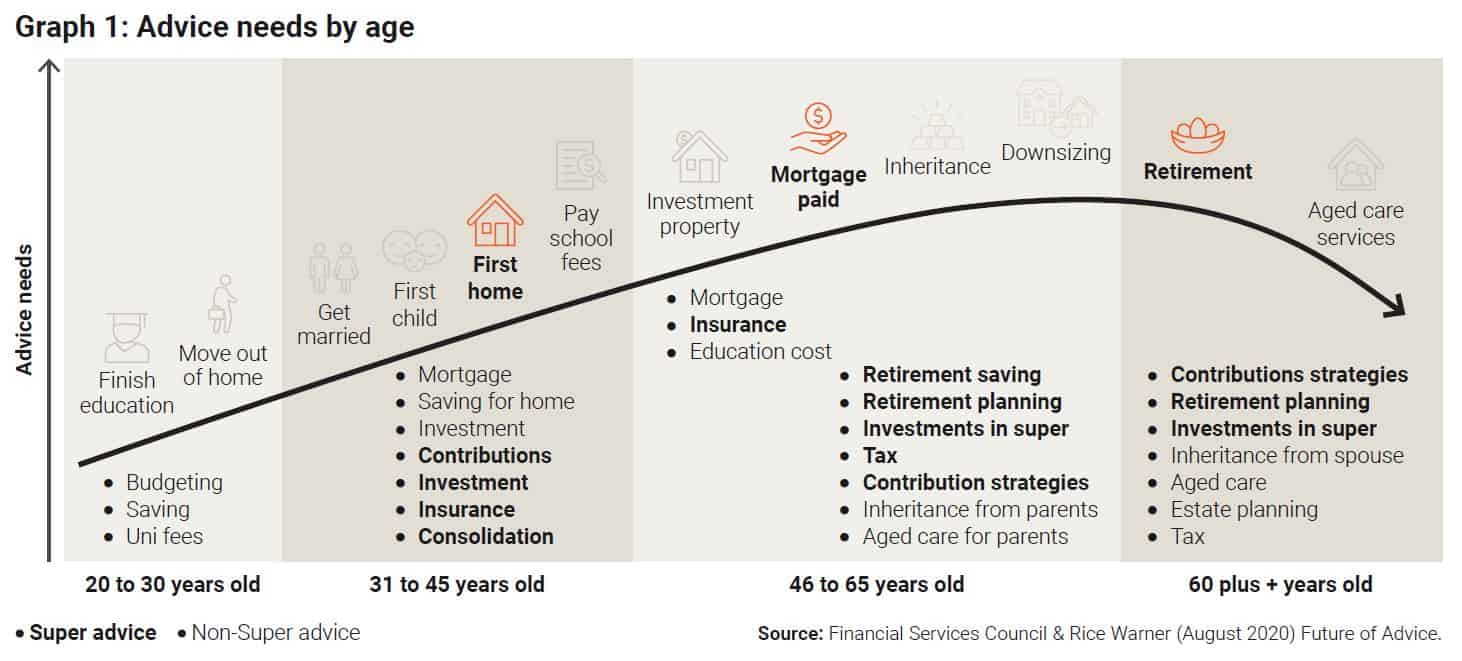

Financial advice has tangible and intangible benefits as previously mentioned. But it can also help individuals navigate challenges and opportunities that present themselves within all life stages, as outlined in Graph 1.

A professional financial adviser can help provide a unique individual plan to help improve financial security throughout all life stages and keep the ‘big-picture’ in sight.

1 University of Melbourne (2019) How Australians feel about their finances and financial service providers. Retrieved from www.unimelb.edu.au/__data/assets/pdf_file/0005/3145613/Consumer_Research_Report.pdf

2 Australian Unity (14 May 2019) Research finds financial advice brings benefits beyond the dollar

3 AFA (2018) Value of Advice. Retrieved from www.loomisfinancial.com.au/wp-content/uploads/2018/12/afa_Value-of-Advice-report_oct_2018_final.pdf

4 Russell Investments (2020) Value of an Adviser Report. Retrieved from https://russellinvestments.com/au/support/financial-adviser/business-solutions/practice-management/value-of-an-adviser

5 Russel Investments (2020) In challenging times, financial advisers still deliver value of 5.2%p.a. or more to their clients https://russellinvestments.com/au/about-us/press/2020/in-challenging-timesfinancial-advisers-still-deliver-value

6 Financial Services Council & Rice Warner (August 2020) Future of Advice. Retrieved from https://www.ricewarner.com/wp-content/uploads/2020/10/RW-Future-of-Advice-Report.pdf

Important information

This is a publication of Australian Unity Personal Financial Services Limited ABN 26 098 725 145 (AUPFS), AFSL 234459. Its contents are current to the date of publication only, and whilst all care has been taken in its preparation, AUPFS accepts no liability for errors or omissions. This report is general in nature and does not take into account the objectives or circumstances of any particular individual or entity. It cannot be relied upon as a substitute for personal financial, taxation or legal advice.

The information transmitted is intended only for the person or entity to which it is addressed and may contain confidential and/or privileged material. Any review, retransmission, dissemination or other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. If you received this in error, please contact the sender and permanently delete the material from your computer system. We cannot guarantee that this e-mail is virus-free. You should scan attachments with the latest virus scan before opening. We will not be liable for any loss, cost or damage of any kind whatsoever caused by any receipt or use of this e-mail and attachments.

Dennis Souksamlane and Defined Financial Advice Pty Ltd are Authorised Representatives of Personal Financial Services Limited (ABN 26 098 725 145), AFS Licence no. 234459. The information provided on this website is general in nature. Any advice on this website is general advice only and does not take into account the objectives, financial situation or needs of any particular person. It does not represent legal, tax, or personal advice and should not be relied on as such. You should obtain financial advice relevant to your circumstances before making investment decisions. Personal Financial Services Limited is a registered tax (financial) adviser and any reference to tax advice contained in on this website is incidental to the general financial advice it may contain. You should seek specialist advice from a tax professional to confirm the impact of this advice on your overall tax position. Nothing on this website represents an offer or solicitation in relation to securities or investments in any jurisdiction. Where a particular financial product is mentioned, you should consider the Product Disclosure Statement before making any decisions in relation to the product and we make no guarantees regarding future performance or in relation to any particular outcome. Whilst every care has been taken in the preparation of this information, it may not remain current after the date of publication and Personal Financial Services Limited and its related bodies corporate make no representation as to its accuracy or completeness.