The fast spreading but less dangerous COVID-19 variant Omicron couldn’t derail markets in December; equity markets achieved positive returns for the month, and delivered spectacular gains for the calendar year.

Equity market gains have occurred despite the surge in actual inflation (for example, Australia’s headline CPI increased +3.0% in the year to September) and expected inflation – typically, high inflation leads to turbulent share markets. One source of calm for equity markets has been central banks’ continued commitment to “do whatever it takes” to support economies, including quantitative easing, yield curve targeting and maintaining low official cash rates for an extended period. These actions have kept bond yields low, although yields have crept higher during the year – for reference Australia’s 10-year government bond yield increased 0.7% during calendar 2021 (1.67%, versus starting yield of 0.97%) yet the cash rate is still anchored at 0.1%.

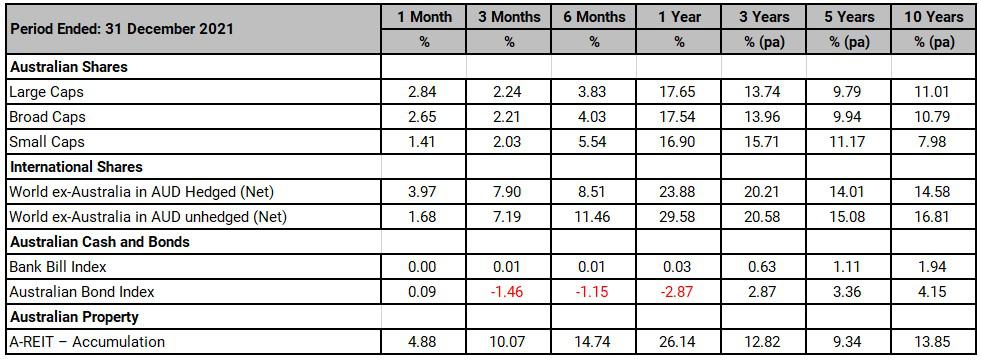

Australian equities were positive in December and over the 12 months to the end of December have delivered a total return of over 17%. International equities were positive in December and for 2021 currency hedged international equities gained 23.9%. A lower Australian dollar over the year bolstered unhedged investors’ returns to an even more impressive gain of 29.6%. In context and taking into consideration the uncertainty that pervaded over this period the returns are exceptional. Australian REITs performed particularly strongly in the month +4.9% and over 12 months thanks to the reopening of economies delivered a great return of 26.1%.

Australian government bond yields moved slightly lower in December with the Australian 10-year government bond yield decreasing by 2ps to 1.67% and the 2-year government bond falling 5bps to 0.59%. US yields rose, with the 10-year government bond yield gaining 7ps to close at 1.51% and the 2-year government bond yield increasing by 17bps to 0.73%.

For 2021 investors who took more risk were rewarded handsomely with equities (both domestic and international) providing strong double-digit returns. Conversely, investors with a passive exposure to Australian fixed interest, perceived to be less risky, suffered a negative return for the year. Whilst strong returns from growth assets are welcomed the year ahead will prove challenging. Surging COVID-19 cases, rising inflation and an unwinding of accommodative central bank policy settings all appear headwinds going into 2022. As always investors need to remember the adage of past performance is not indicative of future performance and certainly the well-known saying of caveat emptor has never been truer moving into 2022.

Benchmark Returns

Important information

RESEARCH INSIGHTS IS A PUBLICATION OF AUSTRALIAN UNITY PERSONAL FINANCIAL SERVICES LIMITED ABN 26 098 725 145 (AUPFS). ANY ADVICE IN THIS ARTICLE IS GENERAL ADVICE ONLY AND DOES NOT TAKE INTO ACCOUNT THE OBJECTIVES, FINANCIAL SITUATION OR NEEDS OF ANY PARTICULAR PERSON. IT DOES NOT REPRESENT LEGAL, TAX OR PERSONAL ADVICE AND SHOULD NOT BE RELIED ON AS SUCH. YOU SHOULD OBTAIN FINANCIAL ADVICE RELEVANT TO YOUR CIRCUMSTANCES BEFORE MAKING PRODUCT DECISIONS. WHERE APPROPRIATE, SEEK PROFESSIONAL ADVICE FROM A FINANCIAL ADVISER. WHERE A PARTICULAR FINANCIAL PRODUCT IS MENTIONED, YOU SHOULD CONSIDER THE PRODUCT DISCLOSURE STATEMENT BEFORE MAKING ANY DECISIONS IN RELATION TO THE PRODUCT AND WE MAKE NO GUARANTEES REGARDING FUTURE PERFORMANCE OR IN RELATION TO ANY PARTICULAR OUTCOME. WHILST EVERY CARE HAS BEEN TAKEN IN THE PREPARATION OF THIS INFORMATION, IT MAY NOT REMAIN CURRENT AFTER THE DATE OF PUBLICATION AND AUSTRALIAN UNITY PERSONAL FINANCIAL SERVICES LTD (AUPFS) AND ITS RELATED BODIES CORPORATE MAKE NO REPRESENTATION AS TO ITS ACCURACY OR COMPLETENESS.

Dennis Souksamlane and Defined Financial Advice Pty Ltd are Authorised Representatives of Personal Financial Services Limited (ABN 26 098 725 145), AFS Licence no. 234459. The information provided on this website is general in nature. Any advice on this website is general advice only and does not take into account the objectives, financial situation or needs of any particular person. It does not represent legal, tax, or personal advice and should not be relied on as such. You should obtain financial advice relevant to your circumstances before making investment decisions. Personal Financial Services Limited is a registered tax (financial) adviser and any reference to tax advice contained in on this website is incidental to the general financial advice it may contain. You should seek specialist advice from a tax professional to confirm the impact of this advice on your overall tax position. Nothing on this website represents an offer or solicitation in relation to securities or investments in any jurisdiction. Where a particular financial product is mentioned, you should consider the Product Disclosure Statement before making any decisions in relation to the product and we make no guarantees regarding future performance or in relation to any particular outcome. Whilst every care has been taken in the preparation of this information, it may not remain current after the date of publication and Personal Financial Services Limited and its related bodies corporate make no representation as to its accuracy or completeness.