Research Insights – Market Commentary February 2022

Rising inflation, ongoing supply constraints from COVID related issues and a war shaped investor returns during the month. Whilst the world speculated that the President of Russia was bluffing that he would invade Ukraine, Vladimir Putin unfortunately and probably regretfully on his part called that bluff and invaded Ukraine. Investment markets that were battling higher inflation and central bank tightening monetary policy are now facing more headaches with even higher commodity prices and further supply chain disruptions.

In an attempt to squeeze Russia economically, trade sanctions and restrictions to Russia’s access to global banking transactions have been implemented. Russia is one of the world’s three largest producers of both oil and wheat and these sanctions have seen oil prices rise above US$100 a barrel and wheat hit a multi decade high further exacerbating global inflation. Bond markets are currently battling with rising inflation (pushing yields higher) with investors also looking for a safe haven (buying government bonds for protection and pushing yields lower). Gold, as you would expect in a time of uncertainty, has also risen in value and is close to US$2,000 an ounce.

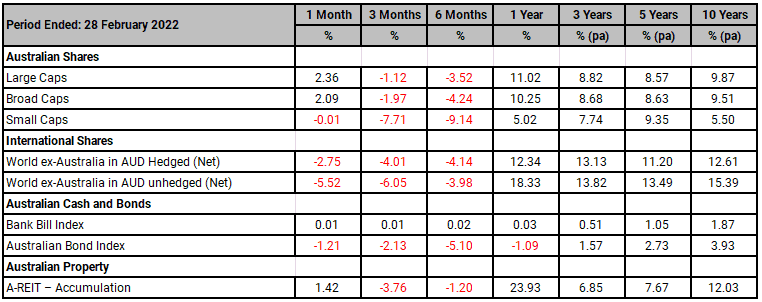

The inflation impulse manifesting itself in rising yields coupled with even higher commodity prices saw Australian large cap equities deliver a positive return in February of 2.4% which was driven by Financials and Materials stocks that together make up over 50% of the domestic stock market. Global equities were negative in the month as investors priced in a series of US rate hikes and also disruption to European markets due to the Russia-Ukraine conflict. Currency hedged International equities fell 2.8% whilst a rising Australian dollar, up 2.6% buying US$0.7252, increased losses for international unhedged equity investors to -5.5%.

Australian government bond yields moved higher in February with the Australian 10-year government bond yield increasing by 24bps to 2.14% and the 2-year government bond rising 22bps to 1.10%. US yields rose, with the 10-year government bond yield gaining 5bps to close at 1.83% and the 2-year government bond yield increasing by 25bps to 1.43%.

Benchmark Returns

Important information

RESEARCH INSIGHTS IS A PUBLICATION OF AUSTRALIAN UNITY PERSONAL FINANCIAL SERVICES LIMITED ABN 26 098 725 145 (AUPFS). ANY ADVICE IN THIS ARTICLE IS GENERAL ADVICE ONLY AND DOES NOT TAKE INTO ACCOUNT THE OBJECTIVES, FINANCIAL SITUATION OR NEEDS OF ANY PARTICULAR PERSON. IT DOES NOT REPRESENT LEGAL, TAX OR PERSONAL ADVICE AND SHOULD NOT BE RELIED ON AS SUCH. YOU SHOULD OBTAIN FINANCIAL ADVICE RELEVANT TO YOUR CIRCUMSTANCES BEFORE MAKING PRODUCT DECISIONS. WHERE APPROPRIATE, SEEK PROFESSIONAL ADVICE FROM A FINANCIAL ADVISER. WHERE A PARTICULAR FINANCIAL PRODUCT IS MENTIONED, YOU SHOULD CONSIDER THE PRODUCT DISCLOSURE STATEMENT BEFORE MAKING ANY DECISIONS IN RELATION TO THE PRODUCT AND WE MAKE NO GUARANTEES REGARDING FUTURE PERFORMANCE OR IN RELATION TO ANY PARTICULAR OUTCOME. WHILST EVERY CARE HAS BEEN TAKEN IN THE PREPARATION OF THIS INFORMATION, IT MAY NOT REMAIN CURRENT AFTER THE DATE OF PUBLICATION AND AUSTRALIAN UNITY PERSONAL FINANCIAL SERVICES LTD (AUPFS) AND ITS RELATED BODIES CORPORATE MAKE NO REPRESENTATION AS TO ITS ACCURACY OR COMPLETENESS.

Dennis Souksamlane and Defined Financial Advice Pty Ltd are Authorised Representatives of Personal Financial Services Limited (ABN 26 098 725 145), AFS Licence no. 234459. The information provided on this website is general in nature. Any advice on this website is general advice only and does not take into account the objectives, financial situation or needs of any particular person. It does not represent legal, tax, or personal advice and should not be relied on as such. You should obtain financial advice relevant to your circumstances before making investment decisions. Personal Financial Services Limited is a registered tax (financial) adviser and any reference to tax advice contained in on this website is incidental to the general financial advice it may contain. You should seek specialist advice from a tax professional to confirm the impact of this advice on your overall tax position. Nothing on this website represents an offer or solicitation in relation to securities or investments in any jurisdiction. Where a particular financial product is mentioned, you should consider the Product Disclosure Statement before making any decisions in relation to the product and we make no guarantees regarding future performance or in relation to any particular outcome. Whilst every care has been taken in the preparation of this information, it may not remain current after the date of publication and Personal Financial Services Limited and its related bodies corporate make no representation as to its accuracy or completeness.