Federal Treasurer Josh Frydenberg has handed down his third Budget, recognising the Government’s emergency support having provided a crucial lifeline to the economy in the face of COVID-19. The impact of COVID-19 will see the deficit reach $161 billion in 2020-21, improving to $106.6 billion in 2021-22, before further improving to $57 billion in 2024-25.

In the next stage of the Government’s economic plan to secure Australia’s recovery, the Budget focused on creating jobs, guaranteeing essential services and building a more resilient and secure Australia.

This will be achieved with a range of measures including personal income tax cuts, business tax incentives, more infrastructure and funding including schools, hospitals, aged care and the NDIS.

It is important to note; the Budget announcements are proposed at this stage and to be legislated. Changes can be made prior to these proposals becoming law.

Tax

Another 12 months of low and middle income tax offset (LMITO)

The Government has extended the LMITO for an additional 12 months meaning the offset will cease 30 June 2022. The LMITO provides an offset of up to $1,080 (singles) and $2160 (dual-income couples) depending on their income as shown below.

Consistent with current arrangements, the LMITO will be received on assessment after individuals lodge their tax returns for the 2021-22 income year.

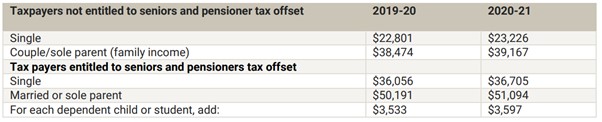

Increasing the Medicare Levy low-income thresholds

Effective 1 July 2020 The Government will increase the Medicare levy low-income thresholds for singles, families, seniors and pensioners from the 2020-21 financial year. The following table compares the level of taxable income below which no Medicare levy becomes payable.

Self-education expenses

$250 threshold to be removed The Government will remove the exclusion of the first $250 of deductions for prescribed courses of education. The first $250 of a prescribed course of education is currently not deductible, only the excess over $250 may be deductible. This measure will have effect from the first income year after the date of assent to the enabling legislation.

Modernising the individual tax residence rules

The Government will replace the individual tax residency rules with a new, modernised framework. The primary test will be a simple bright-line test – a person who is physically present in Australia for 183 days or more in any income year will be an Australian tax resident. Individuals who do not meet the primary test will be subject to secondary tests that depend on a combination of physical presence and measurable, objective criteria. The measure will have effect from the first income year after the date of Royal Assent of the enabling legislation.

Businesses

Temporary outright deduction for capital assets

The Government will extend the temporary full expensing measure by a 12-month period until 30 June 2023. Currently, businesses with aggregated annual turnover up to $5 billion will be able to deduct the full cost of eligible depreciable assets of any value acquired from 7:30pm AEDT on 6 October 2020 and first used or installed ready for use by 30 June 2023. The cost of improvements to existing eligible depreciable assets made during this period can also be fully deducted.

Temporary loss carry-back

Under the temporary loss carry back provisions announced in the last year’s Budget, an eligible company (aggregated annual turnover of up to $5b) could carry back a tax loss for the 2019-20, 2020-21 or 2021-22 income years to offset tax paid in the 2018-19 or later income years.

The Government will extend the eligible tax loss years to include the 2022-23 income year. Tax refunds resulting from loss carry back will be available to companies when they lodge their 2020-21, 2021-22 and now 2022-23 tax returns. This will help increase cashflow for businesses in future years and support companies that were profitable and paying tax but find themselves in a loss position as a result of the COVID-19 pandemic.

Superannuation

Downsizer contributions minimum age reduced to 60

From 1 July 2022, the Government proposes to allow individuals aged 60 or over to make downsizer contributions. The measure will take effect from the start of the first financial year after Royal Assent of the enabling legislation, which the Government expects to have occurred prior to 1 July 2022.

Currently, individuals must be aged 65 or over and meet other eligibility requirements to make a downsizer contribution into their superannuation of up to a maximum of $300,000 (each) from the proceeds of selling their home. The contribution is not a non-concessional contribution, does not count towards contribution caps and is available irrespective of a member’s total superannuation balance.

All other downsizer eligibility criteria remain unchanged, including the requirement to have owned the property for at least 10 years.

Work test to be abolished

The Government proposes to abolish the work test from 1 July 2022.

Currently, the work test applies to members aged 67 to 74* where a person must have been gainfully employed for at least 40 hours in a consecutive 30-day period during the financial year before salary sacrifice or non-concessional contributions can be made. Individuals aged 67 to 74 years will still have to meet the work test to make personal deductible contributions. *For a member turning 75 years old, contributions must be received no later than 28 days after the end of the month that the member turns 75.

First Home Super Saver Scheme (FHSSS) enhancement

The FHSSS is being enhanced to increase the maximum amount of voluntary contributions that can be released from $30,000 to $50,000. This will apply from the start of the first financial year after Royal Assent of the enabling legislation, which the Government expects will occur by 1 July 2022.

Several technical amendments will apply retrospectively from 1 July 2018, including:

- individuals being able to withdraw/amend applications prior to receiving FHSSS amounts and allowing those who withdraw to re-apply for FHSSS releases in future

- increasing the discretion of the Commissioner of Taxation to amend and revoke FHSSS applications,

- allowing the Commissioner of Taxation to return any released FHSSS amounts to superannuation funds, provided money has not yet been released to the individual and

- clarifying that money returned to the Commissioner of Taxation to superannuation funds is treated as non-assessable, non-exempt income of the fund and does not count towards contribution caps of the individual

What is the First Home Super Saver (FHSS) scheme?

From 1 July 2017, voluntary concessional (before-tax) and non-concessional (after-tax) contributions could be made to superannuation to help save for a first home.

From 1 July 2018, these amounts along with associated earnings can be accessed to help purchase a first home (subject to eligibility criteria). Members must apply for and receive a FHSS determination from the Australian Taxation Office (ATO) prior to signing a contract for their first home or applying to release FHSS amounts from their superannuation fund.

For more information, visit www.ato.gov.au and search ‘First Home Super Saver Scheme’.

Scrapping the $450 a month threshold to pay compulsory employer SG

The Government proposes to abolish the requirement that employees must earn $450 a month before employers are required to make compulsory SG contributions. This measure was originally designed to help small businesses to alleviate the administrative burden which is no longer an issue in a world of digital payroll systems.

Individuals working multiple jobs who in the past did not meet the threshold with a single employer will benefit from the measure as it ensures access to additional superannuation savings for all working Australians.

The measure will take effect from the start of the first financial year after Royal Assent of the enabling legislation, which the Government expects to occur prior to 1 July 2022.

Legacy retirement product conversions

The Government will allow individuals to exit a specified range of legacy retirement products, together with any associated reserves for a two-year period. The measure will take effect from the first financial year after the date of Royal Assent of the enabling legislation. The measure will include market-linked, life-expectancy and lifetime products that first commenced prior to 20 September 2007, but not flexi-pension products or a lifetime product in a large APRA-regulated or public sector defined benefit scheme.

Currently, these products can only be converted into another complying non-commutable income streams and limits apply to the allocation of any associated reserves without counting towards an individual’s concessional contribution caps. This measure will permit full access to all the product’s underlying capital, including any reserves, and allow individuals to potentially shift to more contemporary retirement products. Social security and taxation treatment will not be grandfathered for any new products commenced with commuted funds and the commuted reserves will be taxed as an assessable contribution.

Self-Managed Super Funds (SMSFs) – relaxing residency requirements

The Government will relax residency requirements for SMSFs and small APRA-regulated funds (SAFs) by extending the central management and control test safe harbour provisions from two years to five years for SMSFs and removing the active member test for both fund types. Currently under the active member test if a SMSF has active members then at least 50% of the total market value of the fund’s asset must belong to Australian residents for the fund to satisfy the residency test.

This measure will allow SMSF members to continue to contribute to their superannuation fund whilst temporarily overseas i.e. for work or study, ensuring parity with members of large APRA-regulated funds.

Flexibility added to Pension Loans Scheme (PLS)

Uptake of the PLS is to be improved from 1 July 2022 by allowing participants to access up to two lump sum advances in any 12 month period, up to a total value of 50% of the maximum annual rate of the Age Pension.

This equates to around $12,385 per year for singles and $18,670 for couples based on current Age Pension rates. The total amount of loan available each year will still be capped at 150% of the maximum rate of Age Pension. This means any advances taken will reduce the maximum fortnightly loan amount a person can take over the rest of the year.

A No Negative Equity Guarantee will also be introduced so borrowers, or their estate, will not have to repay more than the market value of the property. This proposal brings the PLS in line with other reverse mortgages offered in the market.

What is the Pension Loans Scheme (PLS)?

The PLS is the Government’s version of a reverse mortgage which offers older Australians who own real estate in Australia an income stream to supplement their retirement income.

It is a fortnightly loan of up to 150% of the maximum rate of Age Pension with an interest rate set at 4.5% currently. The loan is secured against real estate in Australia that a pensioner or their partner owns.

For more information on the PLS, visit www.servicesaustralia.gov.au and search ‘Pension Loans Scheme’.

Social security

Child Care Subsidy increase

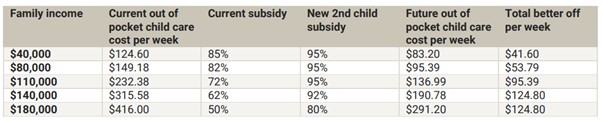

Child Care Subsidy for families with two or more children aged five and under will increase by adding an extra 30 per cent subsidy for every second and third child. The Government also proposes to remove the $10,560 cap on the Child Care Subsidy.

These changes help families to receive up to a 95 per cent subsidy for their second and subsequent children. Benefit for families with two children in child care four days.

*Based on: average hourly centre-based day care rate of $10.40 per hour for a 10-hour session. Source: Treasurer’s joint media release, 2 May 2021

Welfare integrity arrangements strengthened

Taskforce Integrity involves Services Australia and the Australian Federal Police (AFP) working together to prevent, detect and investigate those trying to exploit the welfare system. Additional funding is to be provided, enhancing debt recovery and investigative capacity.

A range of tools available to recover debts from fraud and serious non-compliance include seizure and sale of assets plus the confiscation of bank account, wages and tax refunds.

Other

Aged care funding

In response to the Royal Commission into Aged Care Quality and Safety, a range of measures are proposed to ensure older Australians are treated with respect, care and dignity including:

- from 1 July 2021, releasing an additional 80,000 home care packages by June 2023, bringing the total number of packages to more than 275,000

- early 2022, informal carers and older Australians will have improved access to respite care and support through the Government’s Carer Gateway

- from 1 October 2022, access to better and safer care through a new funding model, the Australian National Aged Care Classification (AN-ACC) which better aligns funding with patient care needs and allows providers to focus on delivering quality and safe care

- from 1 July 2022, better access to aged care information as providers will be required to report care staffing minutes

- from 1 July 2024, increased choice and control as residential care places will be made available where they are needed and

- added focus on new governance arrangements with better system oversight plus skills and training initiatives to bolster staff capability and capacity

Extra support for home buyers

To support home buyers, the Government is:

- establishing the Family Home Guarantee with 10,000 guarantees made available over four years to single parents with dependents. It allows them to purchase a home sooner with a deposit of as little as two per cent

- expanding the New Home Guarantee for a second year, providing an additional; 10,000 places in 2021-22. First home buyers seeking to build a new home or purchase a newly built home will be able to do so with a deposit of as little as five per cent and

- extending the existing HomeBuilder program from six months to 18 months to give people who have already applied additional time to start their build

Digital Economy Strategy

A digital economy strategy aims to grow Australia’s future as a modern and leading digital economy by 2030. Key initiatives to be implemented include:

- Additional funding to support digital skills for Australians

- Enhancing Government services by overhaling myGov and My Health

- Bolstering cybersecurity in government, data centres and future telecommunications networks

Important information

The information provided is current as at 11 May 2021 and is subject to change. This article is not personal financial, taxation or legal advice and should not be relied on as such. Any advice in this document is general advice only and does not take into account the objectives, financial situation or needs of any particular person. You should obtain specialist financial, taxation or legal advice relevant to your circumstances before making investment decisions. Whilst every care has been taken in the preparation of this information, Australian Unity Personal Financial Services Ltd (‘AUPFS’) does not guarantee the accuracy or completeness of it. Where an article is provided by a third party any views in that article are the views of the author and not of AUPFS. AUPFS does not guarantee any particular outcome or future performance. Australian Unity Personal Financial Services Ltd ABN 26 098 725 145, AFSL No. 234459. This document produced in May 2021. ©

Dennis Souksamlane and Defined Financial Advice Pty Ltd are Authorised Representatives of Personal Financial Services Limited (ABN 26 098 725 145), AFS Licence no. 234459. The information provided on this website is general in nature. Any advice on this website is general advice only and does not take into account the objectives, financial situation or needs of any particular person. It does not represent legal, tax, or personal advice and should not be relied on as such. You should obtain financial advice relevant to your circumstances before making investment decisions. Personal Financial Services Limited is a registered tax (financial) adviser and any reference to tax advice contained in on this website is incidental to the general financial advice it may contain. You should seek specialist advice from a tax professional to confirm the impact of this advice on your overall tax position. Nothing on this website represents an offer or solicitation in relation to securities or investments in any jurisdiction. Where a particular financial product is mentioned, you should consider the Product Disclosure Statement before making any decisions in relation to the product and we make no guarantees regarding future performance or in relation to any particular outcome. Whilst every care has been taken in the preparation of this information, it may not remain current after the date of publication and Personal Financial Services Limited and its related bodies corporate make no representation as to its accuracy or completeness.