There were heavy losses for passive bond holders in October as bond yields rose significantly, particularly in Australia. Bond investors are testing central banks’ twin contentions that currently-elevated inflation will prove transitory (and therefore that very low cash rates remain appropriate), and that ongoing bond purchases are necessary to keep medium-term bond yields anchored near zero (an action known as “yield curve control”).

Australian inflation (CPI) rose 3.0% over the 12 months to end-September (i.e. at the top end of the RBA’s 2 – 3% target band). Whilst this outcome was largely anticipated (due to the well-known supply side constraints including a large increase in energy costs and petrol prices), it does call into question the RBA’s prediction of no interest rate rises until 2024.

The RBA have undertaken yield curve control since March 2020, purchasing billions of dollars of shorter-maturity government bonds to keep high-grade yields low. The most recent inflation print has seen the RBA abandon this practice. The knock-on effect has seen bond prices fall sharply and fixed term home loans start to rise. Economists now predict that the RBA will have to raise rates much earlier than 2024, with market pricing-in around 1% of official rate rises by late 2022. However, the RBA “will not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range” which “will require the labour market to be tight enough to generate wages growth that is materially higher than it is currently. This is likely to take some time.”

Growth assets were generally positive as market participants looked through the surging bond yields and focused on the reopening of economies and the positive impact to company earnings. US equities were the main driver of the international equities’ performance, led by the well-known Electric Vehicle manufacturer that was up almost 50% in the month. The FAANG stocks also contributed to performance. International equities rose 5.4% on a currency-hedged basis. With the AUD rising by 3 cents versus the US Dollar to US$0.7518, unhedged equites rose by 1.7%.

The Australian share market was broadly flat. The Energy sector was amongst the worst performers, falling 2.7%, despite West Texas Intermediate oil prices rising 11.4%. Similarly, major iron ore producers languished despite the iron ore price being flat for the month.

Property prices globally have continued to rise thanks to the low interest rate environment and accommodative lending policies, however this is now becoming stressed. In October the Reserve Bank of New Zealand raised rates for the first time in 7 years, in order to curb household debt and moderate property price appreciation. Similar rate hikes have been seen in South Korea, Norway and the Czech Republic. In Australia macroprudential measures are being enhanced with a borrower’s mortgage serviceability being tested with rates at 3% above current debt costs. This should see less loans being granted and an ensuing stabilisation of house prices.

As mentioned previously the changing inflation and interest rate landscape coupled with the attempt to unwind accommodative economic policies has seen bond markets reprice with the Australian 10-year government bond yield increasing by 60bps to 2.09% and the 2-year government bond rising by a significant 73bps to 0.77%. In the US the 10-year government bond rose by 6bps to close at 1.55% and the 2-year government bond yield rose by 22bps to 0.50%.

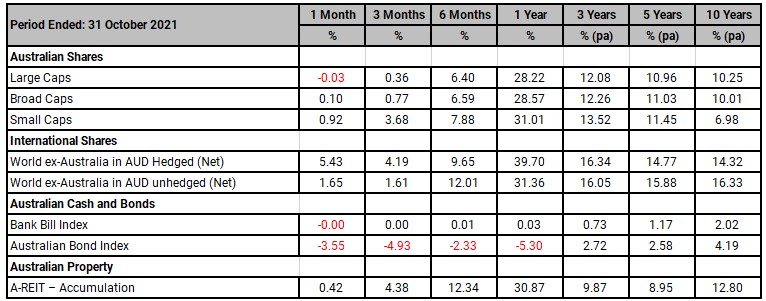

Benchmark Returns

Important information

RESEARCH INSIGHTS IS A PUBLICATION OF AUSTRALIAN UNITY PERSONAL FINANCIAL SERVICES LIMITED ABN 26 098 725 145 (AUPFS). ANY ADVICE IN THIS ARTICLE IS GENERAL ADVICE ONLY AND DOES NOT TAKE INTO ACCOUNT THE OBJECTIVES, FINANCIAL SITUATION OR NEEDS OF ANY PARTICULAR PERSON. IT DOES NOT REPRESENT LEGAL, TAX OR PERSONAL ADVICE AND SHOULD NOT BE RELIED ON AS SUCH. YOU SHOULD OBTAIN FINANCIAL ADVICE RELEVANT TO YOUR CIRCUMSTANCES BEFORE MAKING PRODUCT DECISIONS. WHERE APPROPRIATE, SEEK PROFESSIONAL ADVICE FROM A FINANCIAL ADVISER. WHERE A PARTICULAR FINANCIAL PRODUCT IS MENTIONED, YOU SHOULD CONSIDER THE PRODUCT DISCLOSURE STATEMENT BEFORE MAKING ANY DECISIONS IN RELATION TO THE PRODUCT AND WE MAKE NO GUARANTEES REGARDING FUTURE PERFORMANCE OR IN RELATION TO ANY PARTICULAR OUTCOME. WHILST EVERY CARE HAS BEEN TAKEN IN THE PREPARATION OF THIS INFORMATION, IT MAY NOT REMAIN CURRENT AFTER THE DATE OF PUBLICATION AND AUSTRALIAN UNITY PERSONAL FINANCIAL SERVICES LTD (AUPFS) AND ITS RELATED BODIES CORPORATE MAKE NO REPRESENTATION AS TO ITS ACCURACY OR COMPLETENESS.

Dennis Souksamlane and Defined Financial Advice Pty Ltd are Authorised Representatives of Personal Financial Services Limited (ABN 26 098 725 145), AFS Licence no. 234459. The information provided on this website is general in nature. Any advice on this website is general advice only and does not take into account the objectives, financial situation or needs of any particular person. It does not represent legal, tax, or personal advice and should not be relied on as such. You should obtain financial advice relevant to your circumstances before making investment decisions. Personal Financial Services Limited is a registered tax (financial) adviser and any reference to tax advice contained in on this website is incidental to the general financial advice it may contain. You should seek specialist advice from a tax professional to confirm the impact of this advice on your overall tax position. Nothing on this website represents an offer or solicitation in relation to securities or investments in any jurisdiction. Where a particular financial product is mentioned, you should consider the Product Disclosure Statement before making any decisions in relation to the product and we make no guarantees regarding future performance or in relation to any particular outcome. Whilst every care has been taken in the preparation of this information, it may not remain current after the date of publication and Personal Financial Services Limited and its related bodies corporate make no representation as to its accuracy or completeness.