In February investment markets were heavily influenced by rising government bond yields leading to negative returns from traditional fixed interest benchmarks (prices fall as yields rise) which also saw equities reduce some of their gains in the last week of the month as higher bond yields, with all things being equal, reduce the amount investors are willing to pay for future company earnings

The rise in bond yields is predicated on expectations inflation is moving higher in the future. The combination of low cash rates and short-term bond yields at a time of accelerating economic growth, increasing employment and fiscal stimulus has already seen financial asset prices accelerate in the second half of 2020. The roll-out of multiple COVID-19 vaccines should assist in mitigating against further interruptions to accelerating economic growth. Taking into consideration all of the above the risks of an uplift in inflation are increasing and being priced into 10 year bond prices (through rising yields). It remains to be seen how much of this move is a cyclical uptick or a sustained move to higher levels of inflation.

The Australian equity market was positive in February, the ASX100 up 1.5% with both the Materials and Financial sectors outperforming i.e. inflation and cyclical beneficiaries. The Reporting season was solid with FY21 earnings upgraded strongly as we come out of 12 months of COVID restrictions. Key features of the reporting season included strong earnings from consumer discretionary companies (strong retail sales) and resources companies (strong iron ore prices). Pleasingly, there was a marked uptick in dividend payments during the reporting season.

International equities rose by 2.7% on a currency-hedged basis while a slightly stronger AUD (moving from US$0.7644 to US$0.7706) decreased returns slightly for unhedged investors to 1.7% for the month. The AUD/USD exchange rate touched US$80c during the month as Australia and therefore the Aussie dollar would be the beneficiary from a global cyclical upswing and overseas investor attracted to the higher yields now on offer from Australian government bonds. Australian listed property fell in February by 2.6%% in response to longer dated bond yields rising.

The Australian yield curve steepened substantially in February with the 10-year government bond yield rising 79bps to 1.92%, while the 2-year government bond yield rose by 1bps to 0.12%. In the US the 10-year government bond rose by 33bps to close at 1.40% and the 2-year government bond yield rose by 2bps to 0.13%.

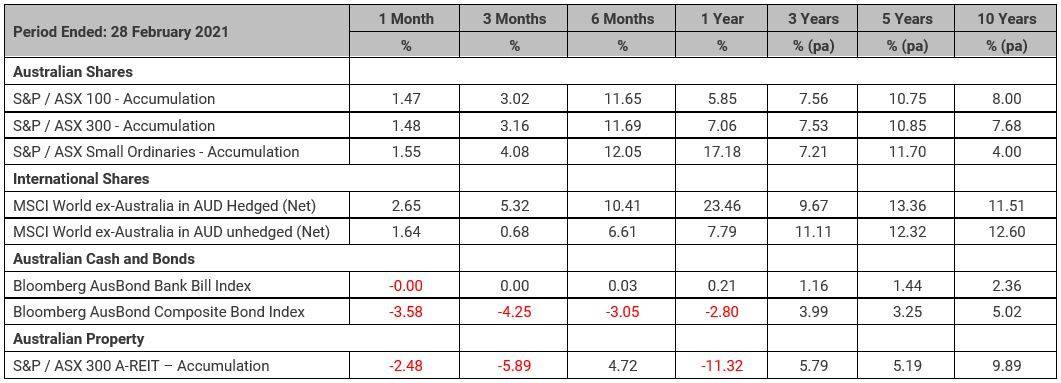

Benchmark Returns 28 February 2021

Important information

RESEARCH INSIGHTS IS A PUBLICATION OF AUSTRALIAN UNITY PERSONAL FINANCIAL SERVICES LIMITED ABN 26 098 725 145 (AUPFS). ANY ADVICE IN THIS ARTICLE IS GENERAL ADVICE ONLY AND DOES NOT TAKE INTO ACCOUNT THE OBJECTIVES, FINANCIAL SITUATION OR NEEDS OF ANY PARTICULAR PERSON. IT DOES NOT REPRESENT LEGAL, TAX OR PERSONAL ADVICE AND SHOULD NOT BE RELIED ON AS SUCH. YOU SHOULD OBTAIN FINANCIAL ADVICE RELEVANT TO YOUR CIRCUMSTANCES BEFORE MAKING PRODUCT DECISIONS. WHERE APPROPRIATE, SEEK PROFESSIONAL ADVICE FROM A FINANCIAL ADVISER. WHERE A PARTICULAR FINANCIAL PRODUCT IS MENTIONED, YOU SHOULD CONSIDER THE PRODUCT DISCLOSURE STATEMENT BEFORE MAKING ANY DECISIONS IN RELATION TO THE PRODUCT AND WE MAKE NO GUARANTEES REGARDING FUTURE PERFORMANCE OR IN RELATION TO ANY PARTICULAR OUTCOME. WHILST EVERY CARE HAS BEEN TAKEN IN THE PREPARATION OF THIS INFORMATION, IT MAY NOT REMAIN CURRENT AFTER THE DATE OF PUBLICATION AND AUSTRALIAN UNITY PERSONAL FINANCIAL SERVICES LTD (AUPFS) AND ITS RELATED BODIES CORPORATE MAKE NO REPRESENTATION AS TO ITS ACCURACY OR COMPLETENESS.

Dennis Souksamlane and Defined Financial Advice Pty Ltd are Authorised Representatives of Personal Financial Services Limited (ABN 26 098 725 145), AFS Licence no. 234459. The information provided on this website is general in nature. Any advice on this website is general advice only and does not take into account the objectives, financial situation or needs of any particular person. It does not represent legal, tax, or personal advice and should not be relied on as such. You should obtain financial advice relevant to your circumstances before making investment decisions. Personal Financial Services Limited is a registered tax (financial) adviser and any reference to tax advice contained in on this website is incidental to the general financial advice it may contain. You should seek specialist advice from a tax professional to confirm the impact of this advice on your overall tax position. Nothing on this website represents an offer or solicitation in relation to securities or investments in any jurisdiction. Where a particular financial product is mentioned, you should consider the Product Disclosure Statement before making any decisions in relation to the product and we make no guarantees regarding future performance or in relation to any particular outcome. Whilst every care has been taken in the preparation of this information, it may not remain current after the date of publication and Personal Financial Services Limited and its related bodies corporate make no representation as to its accuracy or completeness.