August was another strong month for growth assets. US equities, as measured by S&P 500, posted their 7th successive monthly gain whilst in Australia the S&P/ASX 300 posted its 11th successive monthly gain, its longest winning streak since the index’s inception in 1980. This was despite heightened geo-political uncertainty surrounding the US exit of Afghanistan with the Taliban easily taking control of Kabul. In addition, the COVID Delta variant accelerated its spread globally with the US and UK seeing 200,000 and 30,000 cases respectively a day which will see a full return to work and school delayed. In China, whilst cases are not high, a major port was shut down to limit spreading from a COVID infected worker. If such instances continue around the globe it pushes out economic recovery in addition to sustaining supply chain disruptions and increases the potential for sustained higher levels of inflation.

Australian unemployment fell in July to 4.6% however this was mainly due to a fall in the participation rate. The underemployment rate rose from 7.9% to 8.3% indicating that whilst people are employed, many still want to increase their hours. Anecdotally, it’s clear that with the lockdowns and service sector disruptions, the unemployment figure doesn’t truly reflect the fragility of the economic recovery, with some sectors of the economy remaining deeply impacted by lockdowns in New South Wales and Victoria.

The Australian share market was positive in August with large caps up 2.3%. Financial reporting season, which occurred largely during August, saw several major companies increase profits and return capital back to shareholders via increased dividends and share buybacks. There has also been a notable uptick over the past few months in corporate activity.

International equities rose in the month, gaining 2.7% on a currency-hedged basis. The AUD, whilst steady versus the US Dollar at US$0.7311, did weaken against other currencies resulting in a 3.1% gain for unhedged international equity investors. Australian small caps benefitted from a good reporting season and returned 5.0% for the month, AREITS were the standout rising 6.3% in the month.

Australian Bond yields ended the month lower, a nod to the uncertainty with a large percentage of the nation in lockdown, the Australian 10-year government bond yield declined 2bps to 1.16% and the 2-year government bond fell 3bps to 0.01%. In the US the 10-year government bond rose by 9bps to close at 1.31% and the 2-year government bond yield rose by 3bps to 0.21% as the US Federal Reserve’s tone is becoming more “hawkish” implying that the US Federal Reserve may begin to curtail (taper) some of its quantitative easing measures early than investors had previously expected.

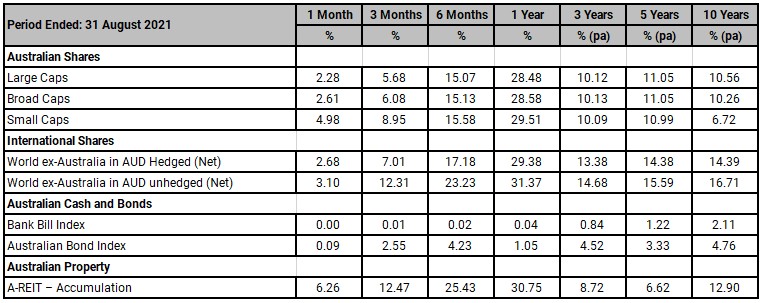

Benchmark Returns

Important information

RESEARCH INSIGHTS IS A PUBLICATION OF AUSTRALIAN UNITY PERSONAL FINANCIAL SERVICES LIMITED ABN 26 098 725 145 (AUPFS). ANY ADVICE IN THIS ARTICLE IS GENERAL ADVICE ONLY AND DOES NOT TAKE INTO ACCOUNT THE OBJECTIVES, FINANCIAL SITUATION OR NEEDS OF ANY PARTICULAR PERSON. IT DOES NOT REPRESENT LEGAL, TAX OR PERSONAL ADVICE AND SHOULD NOT BE RELIED ON AS SUCH. YOU SHOULD OBTAIN FINANCIAL ADVICE RELEVANT TO YOUR CIRCUMSTANCES BEFORE MAKING PRODUCT DECISIONS. WHERE APPROPRIATE, SEEK PROFESSIONAL ADVICE FROM A FINANCIAL ADVISER. WHERE A PARTICULAR FINANCIAL PRODUCT IS MENTIONED, YOU SHOULD CONSIDER THE PRODUCT DISCLOSURE STATEMENT BEFORE MAKING ANY DECISIONS IN RELATION TO THE PRODUCT AND WE MAKE NO GUARANTEES REGARDING FUTURE PERFORMANCE OR IN RELATION TO ANY PARTICULAR OUTCOME. WHILST EVERY CARE HAS BEEN TAKEN IN THE PREPARATION OF THIS INFORMATION, IT MAY NOT REMAIN CURRENT AFTER THE DATE OF PUBLICATION AND AUSTRALIAN UNITY PERSONAL FINANCIAL SERVICES LTD (AUPFS) AND ITS RELATED BODIES CORPORATE MAKE NO REPRESENTATION AS TO ITS ACCURACY OR COMPLETENESS.

Dennis Souksamlane and Defined Financial Advice Pty Ltd are Authorised Representatives of Personal Financial Services Limited (ABN 26 098 725 145), AFS Licence no. 234459. The information provided on this website is general in nature. Any advice on this website is general advice only and does not take into account the objectives, financial situation or needs of any particular person. It does not represent legal, tax, or personal advice and should not be relied on as such. You should obtain financial advice relevant to your circumstances before making investment decisions. Personal Financial Services Limited is a registered tax (financial) adviser and any reference to tax advice contained in on this website is incidental to the general financial advice it may contain. You should seek specialist advice from a tax professional to confirm the impact of this advice on your overall tax position. Nothing on this website represents an offer or solicitation in relation to securities or investments in any jurisdiction. Where a particular financial product is mentioned, you should consider the Product Disclosure Statement before making any decisions in relation to the product and we make no guarantees regarding future performance or in relation to any particular outcome. Whilst every care has been taken in the preparation of this information, it may not remain current after the date of publication and Personal Financial Services Limited and its related bodies corporate make no representation as to its accuracy or completeness.