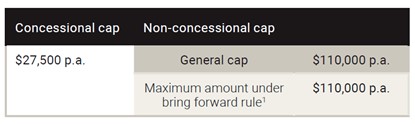

From 1 July 2021, the concessional and non-concessional contributions caps are set to increase due to indexation:

As part of this indexation, the general Transfer Balance Cap will increase from $1.6 million to $1.7 million. Some common questions regarding how indexation will impact super is addressed below.

Does this affect my ability to make non-concessional contributions from 1 July 2021?

Non-concessional contributions are personal contributions made into super sourced from after tax income e.g. using your personal savings to contribute.

To be eligible to make a non-concessional contribution, you must be under 67 or have satisfied the work test at the time when contribution is made. Your available non-concessional cap depends on your total superannuation balance as noted below.

The bring-forward rule allows those under age 65 (who are not already in an existing bring forward period) to make up to three financial years’ worth of non-concessional contributions to their super in a single income year without incurring excess contributions tax (currently 47%). Essentially, the rule allows you to ‘bring forward’ your next two years of non-concessional contributions general cap into the current financial year.

If you are not eligible to access the bring-forward rule, you may only make a non-concessional contribution of up to $100,000 if your total super balance on 30 June 2021 was less than $1.7 million.

There is a proposal currently before parliament to allow members aged 65 and 66 to use the bring forward rule. If legislated, members under age 67 may access the bring forward rule.

I have previously triggered the bring forward rule and am still in a bring-forward period, am I able to make additional non-concessional contributions due to this indexation?

No – as you have previously triggered the non-concessional contribution bring-forward rule and are still in a bring forward period, the total amount of non-concessional cap you have brought forward remains $300,000. You will not benefit from the increase in the non-concessional cap until the bring-forward period expires.

For example, if you triggered the bring-forward rule in 2020- 21 your bring forward period expires at the end of the 2022-23 financial year.

How does the general transfer balance cap indexation affect my super?

The transfer balance cap places a lifetime limit on the amount of super you can transfer into retirement phase income streams, including pensions and annuities. When the general transfer balance cap indexes, it may alter the amount of super you can transfer into retirement phase income streams accordingly.

As you transact on your super by commencing/commuting retirement phase income streams, events that count towards your transfer balance cap are recorded against a transfer balance account. Essentially, a record of credits and debits. If you had a transfer balance account before 1 July 2021, your transfer balance cap will be:

- $1.6 million if, at any time between 1 July 2017 and 30 June 2021, the balance of that account was $1.6 million or more

- between $1.6 and $1.7 million in all other cases, based on the highest ever balance of your transfer balance account.

If you commence a retirement phase income stream and start a transfer balance account after 1 July 2021, your transfer balance cap will be $1.7 million.

If at any time your transfer balance account exceeds your transfer balance cap, you may incur excess transfer balance tax and any excess amount will need to be removed from the retirement phase.

This information has been produced by Australian Unity Personal Financial Services Ltd (‘AUPFS’) ABN 26 098 725 145, AFSL & Australian Credit Licence 234459. Any advice in this document is general advice only and does not take into account the objectives, financial situation or needs of any particular person. It does not represent legal, tax, or personal advice and should not be relied on as such. You should obtain financial advice relevant to your circumstances before making investment decisions. AUPFS is a registered tax (financial) adviser and any reference to tax advice contained in this document is incidental to the general financial advice it may contain. You should seek specialist advice from a tax professional to confirm the impact of this advice on your overall tax position. Nothing in this document represents an offer or solicitation in relation to securities or investments in any jurisdiction. Where a particular financial product is mentioned, you should consider the Product Disclosure Statement before making any decisions in relation to the product and we make no guarantees regarding future performance or in relation to any particular outcome. Whilst every care has been taken in the preparation of this information, it may not remain current after the date of publication and AUPFS and its related bodies corporate make no representation as to its accuracy or completeness. Published: April 2021 © Copyright 2021

Dennis Souksamlane and Defined Financial Advice Pty Ltd are Authorised Representatives of Personal Financial Services Limited (ABN 26 098 725 145), AFS Licence no. 234459. The information provided on this website is general in nature. Any advice on this website is general advice only and does not take into account the objectives, financial situation or needs of any particular person. It does not represent legal, tax, or personal advice and should not be relied on as such. You should obtain financial advice relevant to your circumstances before making investment decisions. Personal Financial Services Limited is a registered tax (financial) adviser and any reference to tax advice contained in on this website is incidental to the general financial advice it may contain. You should seek specialist advice from a tax professional to confirm the impact of this advice on your overall tax position. Nothing on this website represents an offer or solicitation in relation to securities or investments in any jurisdiction. Where a particular financial product is mentioned, you should consider the Product Disclosure Statement before making any decisions in relation to the product and we make no guarantees regarding future performance or in relation to any particular outcome. Whilst every care has been taken in the preparation of this information, it may not remain current after the date of publication and Personal Financial Services Limited and its related bodies corporate make no representation as to its accuracy or completeness.