Research Insights – Market Update

It has been a tumultuous start to 2022 for investment markets with many markets suffering sharp falls year to date.

In this Research Insights we attempt to simplify what has occurred, the impacts to households and businesses, the impacts on inflation and ramifications for investment markets.

What has happened?

There has been a confluence of events that have led to higher inflation over the past year, these include:

Economies moving out of COVID-19 related lockdowns which has resulted in large shifts in demand as economies open up along with bottlenecks in supply chains as businesses attempt to ramp up activity.

China’s zero-COVID policy has added to global supply chain disruptions this year as lockdowns have been strictly enforced over a number of weeks in major cities. This has severely disrupted the operation of schools, factories and businesses in China and as a result placed further pressure on global supply chains and dramatically changed consumption patterns within China.

The invasion of Ukraine by Russia earlier this year has been a major geo-political event and Russia is a significant producer of a number of key commodities. In particular, Russia is one of the three largest oil exporting nations globally and Russia supplies nearly 40% of Europe’s natural gas requirements and is an important source of energy for Europe.

These three major events have seen inflation globally rise to levels not seen since the 1970’s which may cause long term distress to households and businesses that are ultimately being impacted by rising costs. Rising costs include groceries, energy, raw materials, labour and increased borrowing/repayment costs which is why investment markets are reflecting these uncertainties with lower asset prices.

The initial central bank narrative in 2021 and early 2022 was that inflation was transitory and thus not permanent or warranting any changes in central bank policy. The narrative has now changed to one of inflation being stickier and more prolonged and therefore central bank action is needed to stabilise economies.

Chart 1: Australia’s Consumer Price Index, inflation has been rapidly causing central banks to rethink their current accommodative policy settings.

Source: Bloomberg LP

Central Banks reaction

In 2020 Central banks such as the US Federal Reserve and the Reserve Bank of Australia chose to lower official cash rates aggressively in response to COVID-19 and the lockdowns that ensued in order to support liquidity within the financial system. Central banks also adopted other measures such as quantitative easing (QE) –a policy whereby a central bank buys securities such as government bonds in an effort to reduce interest rates and increase the supply of money to encourage increased lending to both businesses and consumers.

However with inflation rising rapidly in 2022 the emergency settings deployed by central banks in 2020 is now being reversed in order to “tame” inflation and create an orderly economy away from spiralling costs.

Many central banks have mandated inflation targets which they must target. For instance, the RBA has an inflation target of 2-3%. Inflation has moved significantly above these targets in 2022 and as a result, a change to policy settings not limited to raising official cash rates is being deployed by central banks in an effort to stem demand and as a result bring demand/supply imbalances throughout the economy closer to equilibrium.

It is important to note that some of the imbalances are not due to domestic factors and the policies don’t address supply chain disruptions.

Chart 2: US Fed Funds Rate. US Federal Reserve response to the spike in inflation i.e. cash rate increases.

Source: Bloomberg LP

Investment Market reactions

In broad terms, the downturn in investment markets can be attributed to two key factors: Risk appetite and valuation.

As outlined above, several global events have conspired during 2022 to increase investor anxiety which include Russia’s invasion of Ukraine, Chinese lockdowns of major cities as it adheres to its zero-COVID policy and higher global commodity prices (more info further below). The implications of these events so far in 2022 have been large and continue to negatively impact investor sentiment. Considering the uncertainty regarding how these events get resolved and over what time frame investors have rightfully adopted a more cautious stance.

The other important consideration for investors during 2022 has been the rapidly changing dynamics of incentive to take risk or opportunity cost. Central banks around the world have begun to raise official cash rates that in many countries including Australia approached zero in 2020 after COVID-19. The increase in official cash rates such as Australia’s RBA Cash Rate has provided investors with an increasingly attractive, risk-free alternative to other asset classes. As such investors have moved from an environment where “There Is No Alternative” (TINA) to one where there is an alternative. As these dynamics change it is reasonable to expect investor risk appetite to dissipate.

Investors have adjusted to an environment where central banks have been increasing cash rates and expect further central bank cash rate increases. The expectations of further future cash rate rises along with expected elevated inflation levels have resulted in rising bond yields, and as bond prices move in opposite direction to yields it has seen negative returns for bond holders.

Additionally, many growth assets derive part of their valuation from the cost of capital (simplistically bond yields), and rising bond yields sees the price investors are willing to pay for growth assets fall. Higher inflation can also impact a company’s earnings as raw materials and labor cost increase and if these extra costs cannot be passed through to the end consumer earnings will also fall. This uncertainty of earnings in future years coupled with higher bond yields has seen growth assets such as equities sell off aggressively.

Table 1: Shows the degree to which returns have been impacted by the changing economic environment year to date. However, over the long-term returns have been more than robust.

Chart 3: Australian equity price history. Time horizon to investments is important, the chart demonstrates that equities are a long-term investment and selling when market events occur has proven to be detrimental to portfolio outcomes noting the sell-off caused by BREXIT in 2016 and the COVID sell-off in 2020.

Source: Bloomberg LP

Further details on some of the various factors influencing inflation and investment markets:

Chinese lockdowns impact. China’s auto sales were reported to be 32% lower in April 2022 from year ago levels. A combination of reduced sales due to dealership closures combined with low availability of stock due to component shortages has led to the decline. The supply chain disruptions have reverberated globally with many multi-nationals reliant on Chinese based factories to produce goods. The disruption to supply chains is resulting in many companies reconsidering their global production strategies and looking to relocate or complement existing Chinese production with facilities elsewhere.

Russia/Ukraine Conflict impact. The invasion of Ukraine by Russia earlier this year has been a major geo-political event and the loss of human life within Ukraine is tragic. The threat to Ukraine’s sovereignty has violated a long-held equilibrium in foreign relations and added a new substantial risk to international relations. Countries such as Poland, Romania, Slovakia, Moldova and Hungary face a significant threat if Russia gains control of Ukraine as they have borders with Ukraine. How and when this conflict gets resolved is unclear but it has already had a significant impact on how countries around the globe are thinking about security and trade alliances moving forward.

The economic fallout from the invasion of Ukraine by Russia has been and continues to be momentous. The imposition of trade sanctions by western countries in response to the invasion has steadily increased aiming to debilitate Russia economically and push Russia towards a peaceful, negotiated settlement of the conflict. However, Russia has responded with threats to restrict supply of natural gas to key European customers and demanded payment by customers in Russian roubles. Russia is a globally significant producer of a number of key commodities and may decide to restrict exports of commodities to retaliate against sanctions imposed by western countries.

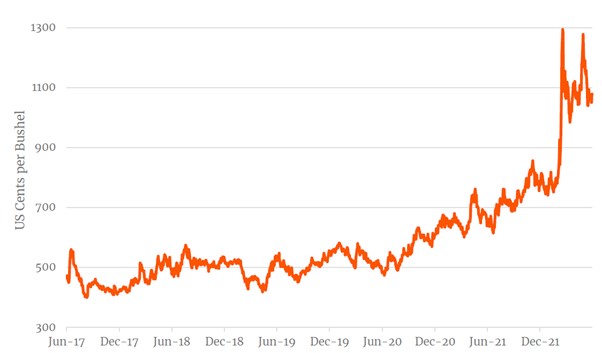

Energy exports aside Russia is one of the three largest producers of wheat globally and the largest exporter of wheat. Importantly, Ukraine is also amongst the ten largest wheat producers and exporters and any decision by Russia to restrict exports has the potential to cause a material imbalance in wheat supply which could see wheat prices move higher. Other commodities where Russia is a globally significant producer include nickel, aluminium, cobalt, platinum and palladium.

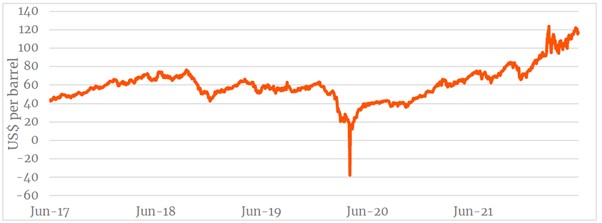

Commodity price rises. The combination of existing supply side constraints, accelerating demand and geo-political uncertainty has created a “perfect storm” for many commodity prices. This has led to some exceptional price rises in some commodities and particularly food and energy related commodities. For instance, the price of West Texas Intermediate oil has surged over 50% year to date and is up over 160% from levels 5 years ago.

Chart 4: WTI Oil Price history. This shows the rise in energy prices from the 2020 lows due to demand increasing via the re-opening of global economies, travel etc and supply decreasing due to Russian sanctions

Source: Bloomberg LP

Wheat price rises. The price of wheat is up over 35% year to date following concerns about wheat supply from both Russia and Ukraine. Importantly, these are essential commodities to the global economy and important contributors to inflation. Wheat prices directly impact both retail consumption and push up raw material costs of other goods that rely on wheat as a key ingredient (pasta, noodles, bread etc).

The significance of the rise in commodity prices such as oil and wheat is that the cost of living is going up at a faster rate than wages. As a result of these rising costs along with other living costs such as increased mortgage servicing costs consumers have less money available to spend on discretionary items and may be forced to utilise savings or borrow more money or curtail spending patterns.

Chart 5: US Wheat futures price history. The rapid rise in wheat prices is significant and could remain elevated for some time due to sanctions that will impact the supply of wheat from Russia/Ukraine.

Source: Bloomberg LP

Conclusion

Financial markets will continue to react to changing economic circumstances moving forward. The success of policy responses by central banks such as raising official cash rates and quantitative easing will be crucial. Central banks are faced with the difficult task of lowering inflation through reducing demand (economic growth) in the economy whilst trying to ensure that economic growth remains positive and economic conditions do not deteriorate to a point where we see a large increase in unemployment.

Taking into consideration the economic impact of these changes to central bank policy will take some time to flow through to official statistics and investor anxiety is likely to remain high for some time. It should, however, be noted that valuations for financial assets are improving and, in some instances, excessive valuations have been removed. However, concerns about the robustness of company earnings and their ability to withstand changes in policy remain and it is likely we will see many companies revise downwards their future expectations for profitability in coming months. This dynamic adds a further uncertainty in the near term.

Investors are having to deal with a changing investment environment and the impact these changes will have on their perception of risk and likely returns moving forward. Higher levels of inflation, increasing interest rates and a change in geo-political risk are all substantial changes to the investment landscape and heightened levels of volatility can be expected. However, it is important to remain focused on your investment strategy and long-term objectives and avoid making reactionary decisions that may compromise these objectives.

If you have concerns or need clarification regarding the appropriateness of your investment strategy or long-term objectives, please contact us to discuss.

IMPORTANT INFORMATION RESEARCH INSIGHTS IS A PUBLICATION OF AUSTRALIAN UNITY PERSONAL FINANCIAL SERVICES LIMITED ABN 26 098 725 145 (AUPFS). ANY ADVICE IN THIS ARTICLE IS GENERAL ADVICE ONLY AND DOES NOT TAKE INTO ACCOUNT THE OBJECTIVES, FINANCIAL SITUATION OR NEEDS OF ANY PARTICULAR PERSON. IT DOES NOT REPRESENT LEGAL, TAX OR PERSONAL ADVICE AND SHOULD NOT BE RELIED ON AS SUCH. YOU SHOULD OBTAIN FINANCIAL ADVICE RELEVANT TO YOUR CIRCUMSTANCES BEFORE MAKING PRODUCT DECISIONS. WHERE APPROPRIATE, SEEK PROFESSIONAL ADVICE FROM A FINANCIAL ADVISER. WHERE A PARTICULAR FINANCIAL PRODUCT IS MENTIONED, YOU SHOULD CONSIDER THE PRODUCT DISCLOSURE STATEMENT BEFORE MAKING ANY DECISIONS IN RELATION TO THE PRODUCT AND WE MAKE NO GUARANTEES REGARDING FUTURE PERFORMANCE OR IN RELATION TO ANY PARTICULAR OUTCOME. WHILST EVERY CARE HAS BEEN TAKEN IN THE PREPARATION OF THIS INFORMATION, IT MAY NOT REMAIN CURRENT AFTER THE DATE OF PUBLICATION ANDAUSTRALIAN UNITY PERSONAL FINANCIAL SERVICES LTD (AUPFS) AND ITS RELATED BODIES CORPORATE MAKE NO REPRESENTATION AS TO ITS ACCURACY OR COMPLETENESS